In his 41 years in government, the economist Benjamin E. Diokno, PhD, has been guided by one powerful oath of citizenship—the Oath of Athenian, engraved prominently in the lobby of Maxwell Hall, the building that houses the Maxwell School Citizenship and Public Affairs of Syracuse University where Ben studied for his Ph.D.

The oath captures Ben Diokno’s own attitude when it comes to his work in government:

“We will ever strive for the ideals and sacred things of the city, both alone and with many; we will unceasingly seek to quicken the sense of public duty; we will revere and obey the city’s laws; we will transmit this city not only not less, but greater, better and more beautiful than it was transmitted to us.”

When the Palace announced that Ben Diokno is the new governor of the Bangko Sentral ng Pilipinas (BSP), my heart leapt with joy. Finally, I said to myself, here is a public servant who can change, drastically, the face of central banking, the fate of banking, and the future of the economy.

Enthused Finance Secretary Carlos “Sonny” Dominguez: “Dr. Benjamin E. Diokno brings together that elusive combination of seasoned technocrat and professional manager.”

“He knows the inner workings of government and industry, and has repeatedly demonstrated the ability to run a large, complex organization with intellectual leadership and a steady hand. All of these will contribute to his successful stewardship of the Bangko Sentral ng Pilipinas as its next governor and chairman of the Monetary Board,” added Dominguez who is instrumental in convincing President Duterte in naming Diokno head of the Philippine central monetary authority, one of the oldest central banks in Asia.

Presidential Spokesman Sal Panelo said Diokno “has competence and has integrity.”

Panelo recalled that Diokno spearheaded investments in growth-enhancing infrastructure programs and innovations, inequality-reducing social services, and peace-enabling initiatives. “A job well done indeed, and expertly at that,” Panelo gushed.

I hope Ben can repurpose BSP to focus on economic production, employment and productivity and not be bogged down by the tedious minutiae of monitoring daily forex and inflation rates, which is missing the forest for the trees.

Under the original central bank law, Republic Act 265 of Jan. 3,1949, the Central Bank of the Philippines (CBP) had three original functions: Monetary stability, peso convertibility, and promoting a rising level of production, employment and real income.

Focus on growth

Its focus on economic growth and employment made the central bank the best in Asia and the Philippines the second richest country in the region, after Japan, for three decades.

From the late 1960s to the early 1970s, Philippine exports were ten times those of Taiwan, South Korea, and Hong Kong. Filipinos were the No. 1 tourists of Hong Kong. The rich Filipinos secured their maids from Hong Kong and Taiwan. The Philippine banking system became the biggest in Southeast Asia. Today, it is the smallest.

Under RA 7653 of June 1993, the third and to me the most important function, which was promoting a rising level of production, employment and real income, was unhappily deleted.

Removing the third function made the BSP governors researchers and bureaucrats who set easy inflation targets like they were picking guavas from a tree—easy (because you pegged an inflation target of between 2% and 4%, can you imagine a target where your maneuver room is 100% and yet still miss it?). The BSP spent billions defending the peso uselessly making the BSP the biggest money-losing enterprise. You know where BSP passed on its colossal losses? To us taxpayers, of course.

Failure in balancing growth

Another function where the Central Bank failed is balanced and sustainable growth of the economy.

Half of Filipino household consumption, especially by the poor, is food. Some 12 million are either jobless or partly employed. Building industries is still the best way to employ people.

Yet, agriculture has been neglected. Its share of GDP is 11%. Industry is a joke. We don’t produce anything much, except babies.

Industry’s share of the economy is 31% of GDP.

The biggest share is Services, 57%, thanks to call centers and business process outsourcing (BPOs), which is basically saliva or sweat, producing dollars.

New BSP law

Ben Diokno comes at a critical time at BSP. There is a new central bank law.

RA 11211 gives BSP awesome powers making it more superior than the Supreme Court, the Department of Justice, the Securities and Exchange Commission, and the Philippine National Police combined.

If you are a bank and the BSP doesn’t like you, the BSP can make inspections of your papers and premises without the benefit of a subpoena (the once every 12 months limit has been removed), penalize you and your officers (the fines have been increased 10-fold and imprisonment doubled) on the say-so of a whistleblower or informer (who will be paid up to P1 million), and worse, padlock or shutter your bank without due process. Unlike before, BSP is not now even obligated to pay your bank’s liabilities following closure. So you lose your bank and you lose your shirt because of loans you must pay.

If you sue BSP officials and personnel, well, the BSP is now funded and empowered to defend its people, the legal fees charged to taxpayers. It will be so difficult to convict them because the threshold of proving criminal liability has been raised so it is not even applied to hardened criminals.

And yes, BSP people can now borrow from the banks they supervise, provided they disclose this fully to the Monetary Board.

I hope Governor Ben Diokno will use his and BSP’s vast powers not to go after the banks in a power trip, but to aggressively push economic growth, promote financial inclusion, and for once, really reduce poverty.

In 2015, Asia and the rest of the world achieved their poverty reduction target of 10%. The Philippines did not.

Perhaps the ancient Athenian Code can provide the answer, to make the Philippines “not only, not less, but greater and more beautiful than it was transmitted to us.” For indeed, the Athenian Code mandates “We will never bring disgrace on this our City by an act of dishonesty or cowardice.”

Reformist budget chief

Ben Diokno, 70, is a reformist technocraft budget secretary. He has solid educational credentials, here and abroad, giving him the gravitas of a technocrat and a conscientious public servant even as he pursued expansionary spending policies under the Corazon Aquino and Rodrigo Duterte administrations.

A pragmatist, he can blend ideal policy reforms with the hustle-bustle of politics and deal-making and still come out on top in the end.

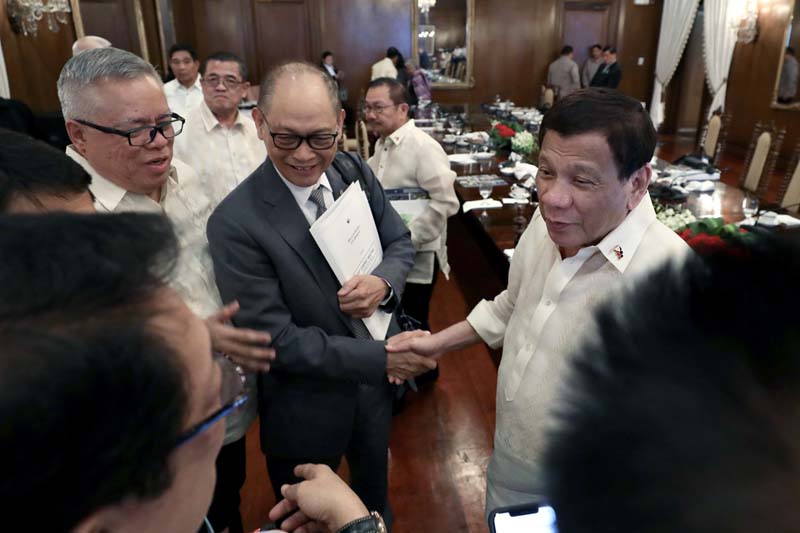

He was President Duterte’s secretary of the Department of Budget and Management (DBM) from July 2016 to March 5, 2019.

He was also the Budget secretary under President Joseph Estrada, from July 1998 January 2001.

He financed a war

When Estrada conducted an all-out war against Muslim separatists and terrorists in Mindanao, Diokno readily provided the funds for the military operations. It paid off. Estrada captured 45 rebels camps, including their headquarters.

Diokno also served as Undersecretary for Budget Operations at the Department of Budget and Management, from 1986 to 1991, during the administration of President Corazon Aquino.

Deficit exceeded ceiling

Aquino exceeded the budget deficit to GDP ceiling (deficit hit more than 5% of GDP) but greater expenditures were needed to revive a slumping economy following the worst political and economic crisis ever in the country.

Under Duterte, Diokno went all out to finance the President’s ambitious “Build, Build, Build” infra buildup and fulfill the former Davao mayor’s campaign promise to double the income of soldiers, policemen, and teachers. Today, soldiers, policemen and teachers are the highest paid civil servants in their respective pay scales.

During the Aquino presidency, Diokno provided technical assistance to several major reforms such as the design of the 1986 Tax Reform Program, which simplified income tax and introduced the value-added tax (VAT), and the 1991 Local Government Code of the Philippines.

Reforms under Estrada

During the Estrada administration, Diokno initiated and instituted several reforms that would enhance transparency and improve the efficiency of the delivery of government services.

The first major reform instituted was the “what you see is what you get” or WYSWYG policy that is a simplified system of fund release for the General Appropriations Act (GAA). This allowed agency heads to immediately plan and contract out projects by just looking at the GAA, which is available in print and at the DBM website, without waiting for the issuance of an allotment authority.

Diokno initiated the reform of the government procurement system (GPS) through the adoption of rapidly improving information and communications technology. He secured technical assistance from the Canadian International Development Agency (CIDA) to help the GPS develop an electronic procurement system along the lines of the Canadian model.

By August 1999, the DBM had two documents necessary to initiate reforms in public procurement.

In early 2000, Diokno and USAID successfully concluded a substantial technical assistance program for the DBM’s budget reform programs, which now included procurement reform.

Other budget reforms instituted by Diokno concerned procedures for payment of accounts payable and terminal leave/ retirement gratuity benefits.

The release of cash allocation were programmed and uploaded to the department’s website while payments were made direct to the bank accounts of specific contractor.

Diokno finished his bachelor’s degree in Public Administration from the University of the Philippines (1968), and earned his master’s in Public Administration (1970) and Economics (1974), also from UP.

He also holds a Master of Arts in Political Economy (1976) from the Johns Hopkins University in Baltimore, Maryland, USA and a Ph.D. in Economics (1981) from the Maxwell School of Citizenship and Public Affairs, Syracuse University in Syracuse, New York, USA.

He is professor emeritus at UP Diliman. Diokno served as Fiscal Adviser to the Philippine Senate. He also served as Chairman and CEO of the Philippine National Oil Company (PNOC) and Chairman of the Local Water Utilities Administration. He was also chairman of the Board of Trustees of the Pamantasan ng Lungsod ng Maynila (City University of Manila).

In his third tour of duty as Budget Secretary, he pursued an expansionary fiscal policy to finance investments in human capital development and public infrastructure.

In addition, he sought passage of a Budget Reform Bill to ensure the compliance of future budgets with the pertinent laws of the land. He also aims to re-organize and professionalize the bureaucracy with a Government Rightsizing Act.

DIOKNO AS BUDGET CHIEF

Budgeting for Build, Build, Build

As a Budget chief, Benjamin Diokno’s job was to ensure that the Duterte administration has enough money to fund its ambitious projects and programs

It was not an easy task. President Duterte wants to make promises without reckoning whether he has money to do it. Like free college education for all. It costs P60 billion a year. Or the immediate reconstruction of war-ravaged Marawi, which costs at least P50 billion.

It was actually Diokno’s second time as budget secretary. His first stint was in 1998 to 2001, under President Joseph Estrada, also a free spender president.

Returning to the Department of Budget and Management (DBM), Diokno found the job bigger and more difficult. Congressmen didn’t like his refusal—to let them help themselves with the P3.8 trillion 2019 budget. They were greedy for pork.

The 2018 budget was a record high P3.35 trillion—21.6% of the projected gross domestic product (GDP).

Diokno also served as Undersecretary for Budget Operations at the Department of Budget and Management, from 1986 to 1991, during the administration of President Corazon Aquino. He is not related to the premier human rights lawyer Atty. Jose Manuel Diokno.

During the Aquino administration, Diokno provided technical assistance to several major reforms such as the design of the 1986 Tax Reform Program, which simplified income tax and introduced the value-added tax (VAT), and the 1991 Local Government Code of the Philippines.

During the Estrada administration, Diokno initiated and instituted several reforms that would enhance transparency and improve the efficiency of the delivery of government services.

As budget chief, Diokno promised a different Duterte administration. “By the time we step down in 2022, we would have ushered in the Golden Age of Infrastructure in the Philippines, an era that Filipinos will look back with affection as one that laid the necessary foundations for robust and equitable growth in the long-term,” he promised.

Diokno says the present poor state of infrastructure reflects decades of neglect and misallocation of public resources.

According to DBM numbers, infrastructure spending as share of Gross Domestic Product (GDP) averaged less than 2% from 1986 to 2016. The sad reality is that if the numbers are stretched over the past 50 years, the infrastructure spending as percentage of GDP has averaged less than 3% — 2.6% to be precise.

This means that while our neighbors were investing heavily in infrastructure to bring about rapid industrialization and growth, the Philippines continued to underinvest which allowed the existing infrastructure to worsen to its current poor state. According to multilateral institutions, the suggested ratio for infrastructure spending as a share of GDP is 5% for developing countries. The Philippines barely reached half of that threshold during the last 50 years.

As a test of resolve to close the infrastructure gap, Diokno said “we are targeting, as a minimum, 5% of GDP, for infrastructure financing in the medium term. For 2017, we allocated 5.4% of GDP to infrastructure development. And for the proposed 2018 budget, we will allocate 6.3% of GDP to infrastructure. In nominal terms, these figures translate to P858 billion and P1.1 trillion for FY 2017 and 2018, respectively.”

To put things in perspective, ten years ago the national budget was P1.1 trillion. In effect, the P1.1 trillion proposed spending for infrastructure in 2018 is just equal to the entire budget of the government ten years ago. “Of course, you have to factor in inflation, but nevertheless, the rise in infrastructure spending is mind-boggling,” Diokno noted.

“We plan to spend P8 to P9 trillion, or approximately $160 to $180 billion dollars, in the next six years. As a share of GDP, infrastructure spending will be ramped up from 5.4% of GDP in 2017 to 7.3% of GDP by 2022. Now you see why this is easily the boldest infrastructure program in our recent history.”

For infrastructure, Diokno said “we will push for 24/7 construction, enforce stronger project monitoring through technology, and embrace the hybrid PPP approach for the swift rollout of projects.”

— Tony Lopez