Global experts in the field of cryptocurrency, blockchain technology and financial technology believe that the Philippines is at the cusp of being crypto-powered and could soon be the next fintech hub in Southeast Asia.

The first ever Philippines-Japan Forum on Investments and Cryptocurrency held in Tokyo recently and organized by the NOAH Foundation, gathered together thought leaders in these new technologies from the Philippines, Australia, USA and Japan in an effort to make more people understand cryptocurrency, blockchain technology and fintech.

NOAH Foundation Director Josef Werker said that the Forum on March 3-5, 2018 has become necessary in the light of heightened excitement on the new technologies and the need to educate the public about them.

“We felt that this is the perfect opportunity to bring together experts to become our knowledge partners so they could best share how cryptocurrency, blockchain technology and fintech, impact the way people live right now, and more importantly how it could affect the way we do things in the future,” Werker said.

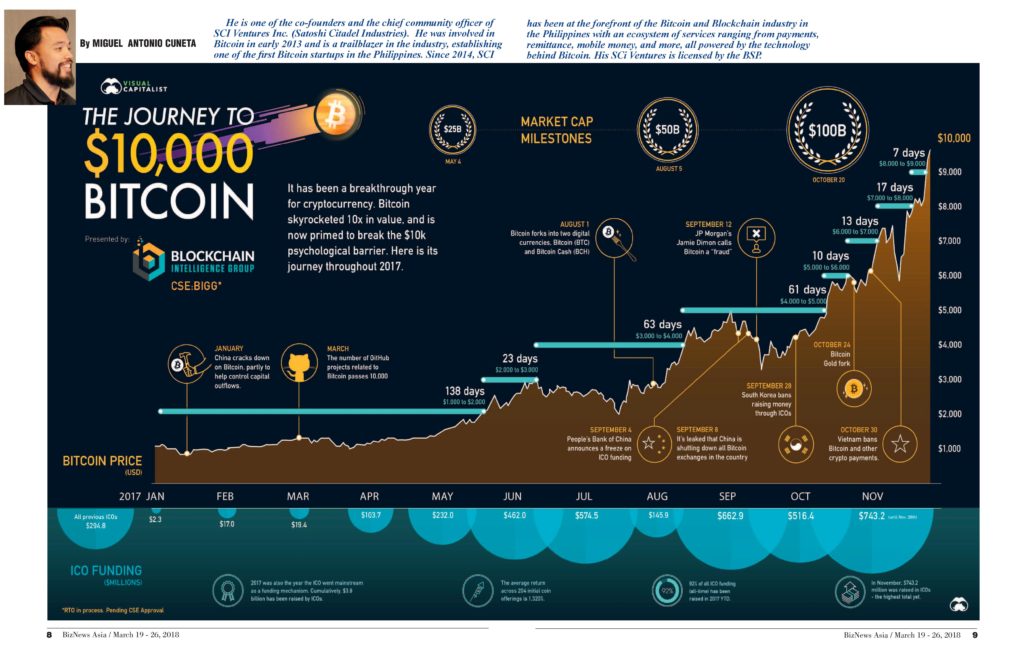

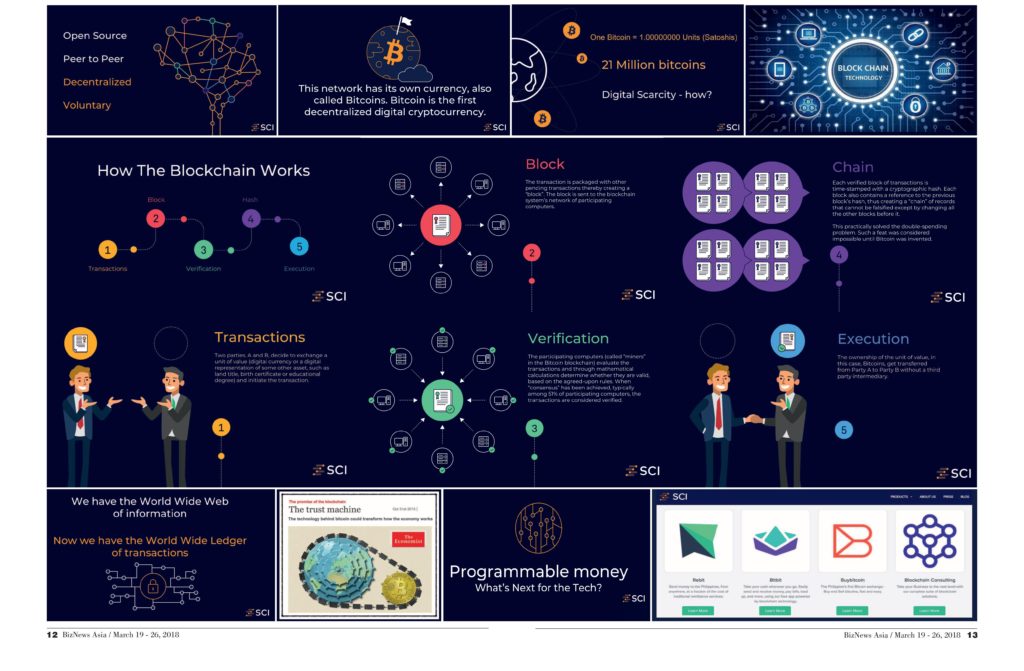

Cryptocurrency and blockchain technology expert Miguel Antonio Cuneta, co-founder and Chief Community Officer of Satoshi Citadel Industries (SCI), said that bitcoin and blockhain technology is the internet of money. They are going to do for finance and governance and banking what the internet did for telecommunications, media and publishing.

More than a currency

“Bitcoin is a technology platform and more than just a currency. It is not an investment scheme and definitely not a get rich quick scheme. It’s a new kind of technology and when technology becomes successful it becomes a utility you just use it. So, technology happens when people have a problem and they want to solve it,” Cuneta explained.

Cuneta cited the problems that bitcoins address.

“The double spending problem is a longstanding computer science problem which arose when we started using the digital world and we wanted to transact with each other. So, when you send something digitally, you can copy this digital thing in unlimited number of times identically and no one would know copy A from copy B. Problem is when you send digital money, how will you know it’s not fake? So the solution was a centralized third party to verify transactions,” he said.

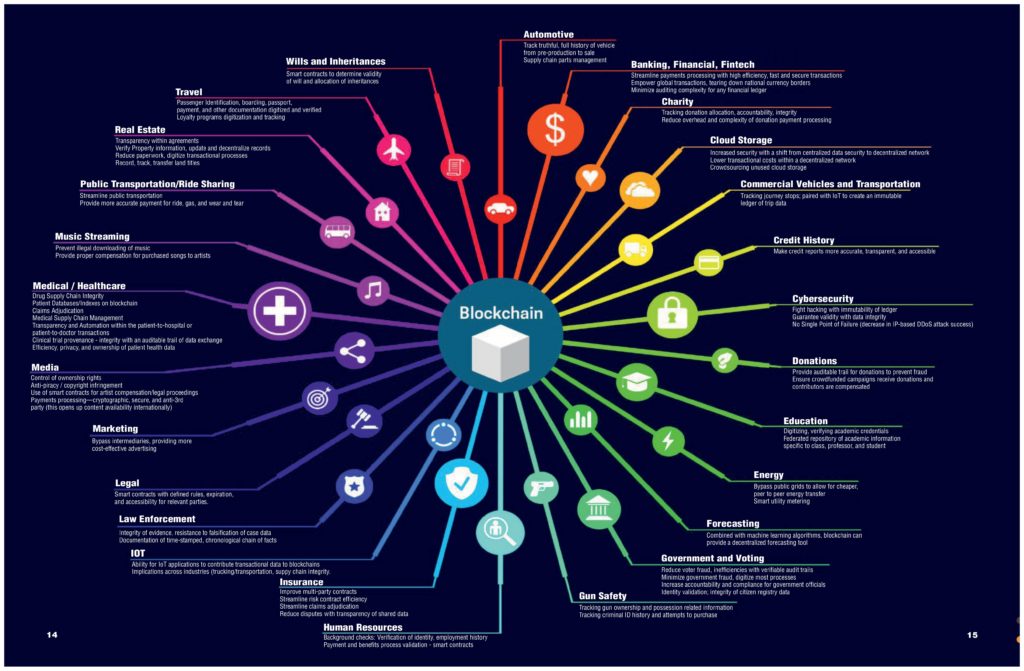

He said that SCI has developed remittance platforms, mobile money, exchange platforms and payment platforms using the technology which is not limited to making money, trading or regulating.

Banks can use the technology

Ron Hose, founder and chief executive officer of Coins.ph said that banks can take advantage of this new technology simply by innovating.

“The future of banking is really moving towards connecting consumers directly with financial services. We are not displacing the existing financial institutions, we are working with them to increase their reach into more consumers. We have done quite well, we have over three million registered customers. We partner with many other prominent players,” he added.

Hose said that the essence is driving convenience and inclusion and the idea that every person deserves to have the same quality of services.

UnionBank

On the banking front, Justo A. Ortiz, chairman of digital banking leader UnionBank explained that right now there is still a huge 99% non-digital transactions in the Philippines and the goal is to get to 20% by 2020. He admitted that there is still a huge gap between over the counter and digital mainstream of e-commerce but he expects the shift to happen faster than expected.

Ortiz said that the Bangko Sentral has been very proactive such that while they have the regulatory mandate, they also came up with agency banking. (See story on pages 34-37)

He added that they are working on a three-year timeline with regard to blockchain technology saying there is a lot of development, a lot of evolution that is happening very quickly.

“I think it is important for people and organizations that are in mainstream activities like ourselves to get onboard even if it is just a learning experience because if you don’t do so, and quoting our (UnionBank) president Edwin Bautista, if you wait for the perfect environment to appear, you are going to meet perfect competition and so we can’t wait, we need to keep going,” Ortiz said.

Ramon Vicente V. de Vera, head of Fintech Business Group at UnionBank further said that the issue is that the legacy systems of banking have kept a lot of companies siloed saying it has precisely been designed for financial exclusion which is the great injustice. He adds that this is financial exclusion at the highest order.

Blockchain-based

“We are building a blockchain-based network, we are going to onboard the rural bank into a blockchain network and there we will be able to send funds to each other real time. With that network, rural banks and their customers can now have access to universal banking products and services. At the same time rural banks who are in those far flung areas can now offer their counters their connected networks to banks, non-banks. That is the vision we are trying to build,” De Vera said.

More importantly, he said, blockchain would not only connect rural banks but would also make their processes more efficient.

De Vera added that blockchain technology may be the answer to the survival of the rural banks, the number of which has dwindled down to 480 from 3,000.

“It is good to know that blockchain technology is moving towards Asia so now we are at the heart of innovation and opportunity,” he said.

Lito Villanueva, managing director of FINTQ and chairman of FinTechAlliance.ph recalled that there were several instances in the past when he met with bank officials to discuss about fintech and he was told that fintech is a disruptor to the banking system.

Fortunately, he was able to explain the system well and to date, from one bank partner three years ago, they now have more than 100 bank and non-bank partners.

FINTQ stressed that the story of financial inclusion would not be complete without considering our Muslim brothers in it.

“This is the reason why we are advocating a Shariah-compliant digital microfinance framework too for our unbanked Muslim brothers,” he said.

The problem of being un-banked , Villanueva said, is not just faced by the poor but even the low medium income class Filipinos and even 36% of the local government units in the country which do not have bank presence.

Blockchain technology and cryptocurrency is now also being used in compensation and benefits, as explained by Judah Hirsch, founder and CEO of the start-up Salarium.

“Blockchain technology gives us a way to really engage our employees that very few companies have. It enables companies to compensate the employees the way they want to. So this is whether thru traditional cash payments, we have also reimbursement for all of their expenses, we also have some rewards programs to enable companies to give them digital gift certificates, digital rewards programs. We also have Sal-Pay tokens. We have actually just completed the ICO ourselves and enables some of our companies to now pay their employees thru the blockchain and pay them in cryptocurrency,” Hirsch said.

He added that they now focus on Sal-Pay, making the employees’ pay go further through e-banking services that would allow employees to digitally organize their finances.

On the wellness front, Ildar Fazulyanov, founder and CEO of Well, said that blockchain technology can actually save lives.

“In the US alone, there are 250,000 deaths caused by medical error. If you extrapolate globally that is five million deaths every year. If you add to that misdiagnosis or non-treatment arguable 40%-50% of the population of the world is not treated,” he laments.

Blockchain technology could help the healthcare industry significantly, he said, first by scaling trust.

“Blockchain is based on trust and healthcare is one of those. In healthcare, one of the biggest problem is doctors hide their mistakes, and so it leads to worst things. And with blockchain you can start working and solving these things,” Fazulyanov said.

Congressman Seth Frederick Jalosjos of the 1st district of Zamboanga del Norte welcomed blockchain technology, cryptocurrency and NOAH Foundation’s interest in Mindanao.

Mindanao

“Mindanao is the perfect platform for this. We are like a sponge, we are so open for ideas, so open for new technology, new ideas, new projects and development. Any talk for the progress of Mindanao is very much taken in,” Jalosjos enthused.

This, he added, is the reason why instead of Mindanao pushing themselves in Imperial Manila, they want to start in a clean slate.

“We are very hungry and very thirsty for something like this to come out of the most neglected islands of the Philippines. This will be a game changer in our country,” Jalosjos said.

NOAH Foundation’s Werker said that the Crypto Token NOAHCOIN, can be used when they travel to Dakak, as an initial resort in the NOAH pipeline.

“When tourists visit Dakak, they need not worry about yen, peso or any fiat currency. They can use NOAH Coin to pay for everything, get discounts, freebies and special experiences that you can’t get if you paid in cash,” Werker said.

Werker said that the NOAHCOIN is inspired by the Hong Kong octopus card that allows tourists to many points of access to shop, transportation and entertainment.

“We applied this idea to an area with far less infrastructure with the use of blockchain technology,” he said. On a bigger picture, Werker said that Dakak is just one of the many resorts that are in the NOAH pipeline.

Horizon Manila is set to build NOAH CITY where NOAHCOIN can be used.

“Our efforts are firmly planted in a forward-facing vision of the Philippines. One where traditionally overlooked regions suddenly tap into the world economy. Where the perennially impoverished can finally taste prosperity without having to leave their homeland and families behind,” he said.

Werker said: “As we begin to empower those opportunities with an economy augmented by cryptocurrency, more than ever, we must commit to dispelling misinformation and create consensus so that knowledge and not fear maps our future.” Werker said that this what NOAHCOIN is doing is a solid case for using cryptocurrencies to help communities.

MIGUEL ANTONIO CUNETA