CEOs identify major growth drivers: infrastructure development, domestic consumption, and government spending.

By Mary Jade T. Roxas-Divinagracia

Managing Partner for Deals and Corporate Finance

Isla Lipana & Co./PwC Philippines

(Presentation, by zoom, before the Sept. 14, 2021 forum, Hindsights, Insights, Foresights: The Future in the Present Tense)

Eighteen months after the first lockdown, our CEOs and business leaders are more confident of the growth prospects, not just of their businesses, but of the industries where they operate.

Almost three quarters of the CEO respondents are confident that their businesses will experience growth in the next 12 months and even more so in the next three years.

While some sectors like technology and financial services may be a bit more confident than others, there is no one sector that is overwhelmingly positive or negative about their prospects.

What the optimism means

Now, what does this tell us?

While the pandemic certainly has a far-reaching impact, how each enterprise responded made a huge impact on how well they are performing now and how they will they continue to adapt to the changes in a COVID or post COVID environment.

What is driving this optimism? What is fueling this confidence?

A year ago, we were not clear when the vaccine would be available. They had very little information about the virus and how to fight it.

In the face of significant uncertainty, CEOs took a more conservative view and prepared for the worst.

Now, thanks to the innovation and the collaboration of businesses and the regulators, we have seen several vaccines make it to the market in record time.

Pandemic can be managed

These vaccines are giving us hope that the pandemic can be managed. And while COVID-19 cannot be fully eradicated for now, at least we are comforted that we live with the virus as long as we get vaccinated and we continue to practice the safety protocols.

We conducted the survey between July and August of this year and even with another ECQ was declared particularly in the NCR, this did not dampen the confidence of our business leaders.

Some of the initiatives that businesses to thrive during these challenging times include quickly adjusting your operations, bringing their businesses online, accelerating their digitization initiatives, and introducing new products for services, and even undertaking new business models.

However, risks and uncertainties remain. The pandemic caused and continue to caused damage to our economy and most people’s livelihood.

And certainly, the Delta, the Mu, and many more variants would continue to pose risk to our health, to our businesses, and to our society at large.

Vaccine rollout needs improvement

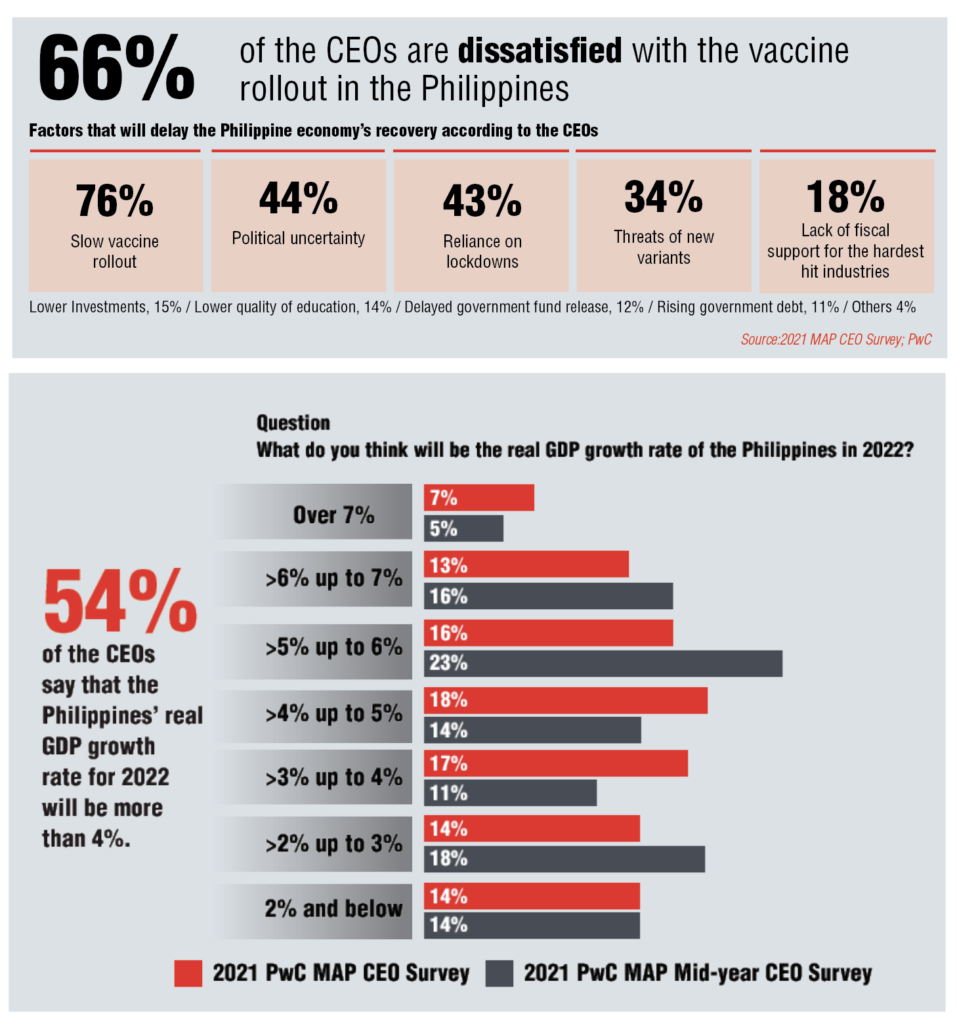

So while the availability of vaccines is keeping us hopeful, two-thirds of our CEOs respondents say that roll-out of the vaccines in the country can be improved.

The slow vaccine roll-out is one of the primary reasons that can derail our economy’s recovery.

They have also cited political uncertainty as the top concern. And given the elections next year, our CEOs are anxious as to what changes in the political personalities and the policies for next year’s election bring.

They have also expressed concerns that the continuing reliance on lockdowns will further impede our nation’s economic recovery.

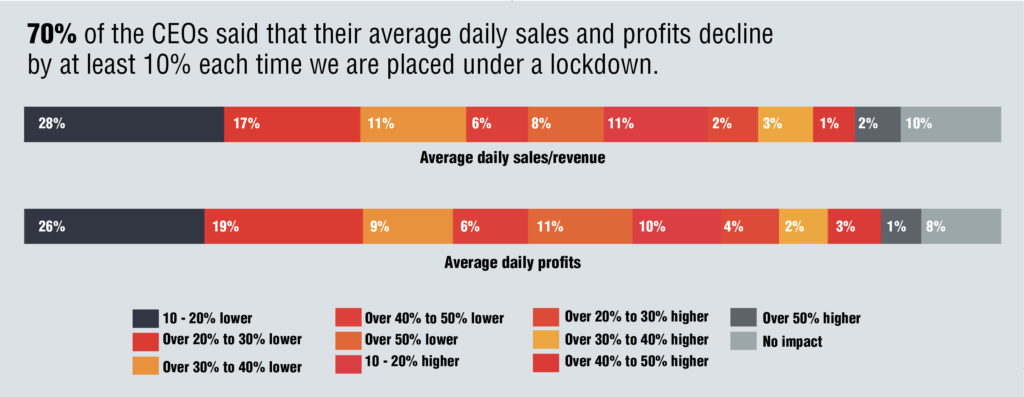

Lockdowns cut sales by at least 10%

In fact, about 70% of our CEOs said that for every ECQ, MECQ, or even GCQ that is in effect, they lose at least 10% of their sales and there’s a corresponding impact on their bottomline.

Several businesses groups, including the MAP, have called on the government to identify other countermeasures to control the spread of COVID, aside from simply declaring lockdowns.

Retailers have called upon the government to expedite the vaccine rollout, allow the private sector to purchase vaccines for their employees, allow fully vaccinated customers in their retail premises on certain days, and generally, just asking the government to open the economy.

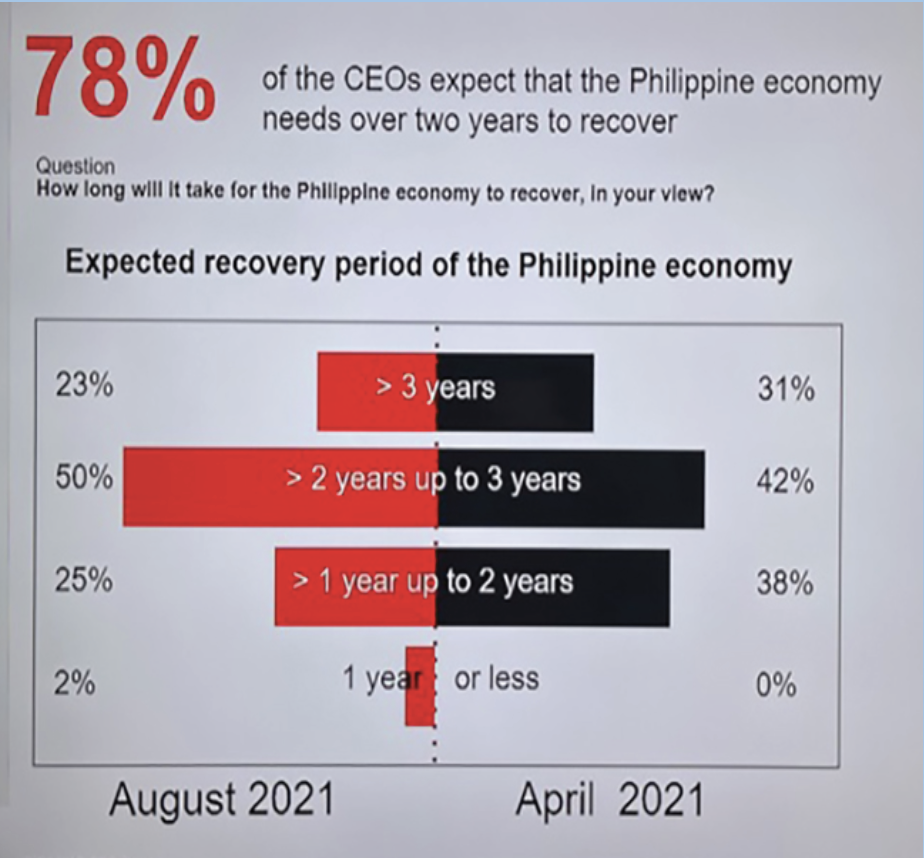

Recovery in two-three years

Despite these challenges, more than half of our CEOs also believe that we will see more than a 4% of GDP growth rate next year, and that the economic recovery will happen between two to three years.

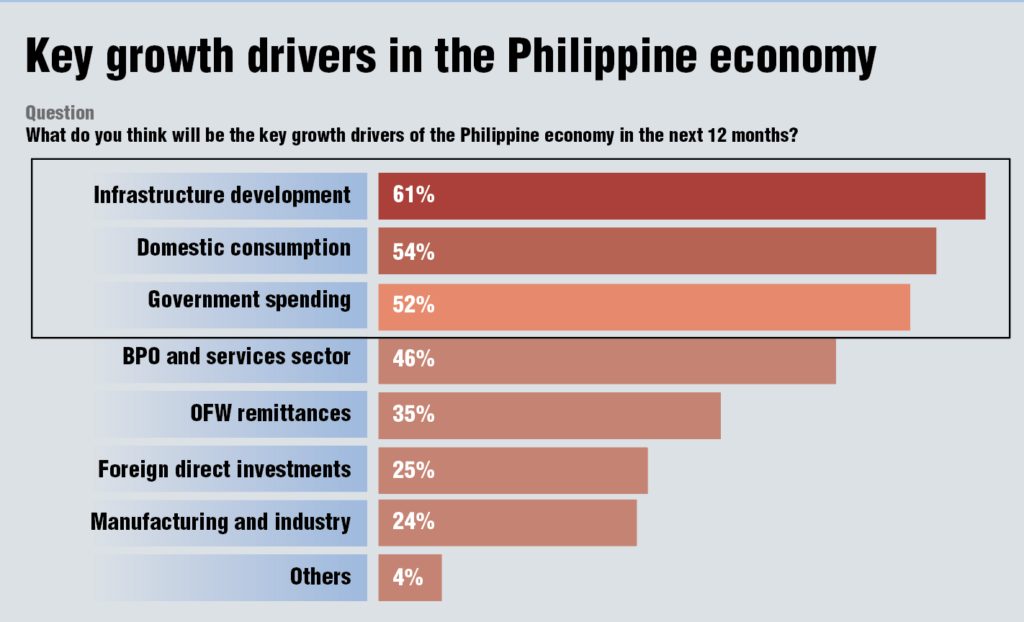

Our CEOs identified major growth drivers for the economy and consistent with the responses in the previous year, these are: infrastructure development, domestic consumption, and government spending.

Not surprisingly, given the experience of our hospitals and healthcare workers and responding to COVID cases since the pandemic broke up, our CEOs say healthcare that should be the top priority of the government.

More needed on infrastructure

Infrastructure has been consistently identified is a priority even pre-pandemic and certainly, while infrastructure has been in the center of both the Aquino and the Duterte administrations still a lot needs to be done.

We need to have good infrastructure in a place to enhance our competitiveness and attract more investments into the country.

However, for the first time in the CEO survey, education figured in the Top 3.

The CEOs have expressed concerns that the two years of online learning have long-term repercussions on productivity and the economy.

In fact, the ADB has estimated the students from the Philippines are at risk of lower earnings of up to $155 dollars a year as a result of less effective online learning.

Changes here to stay

This will further exacerbate the income disparity between different segments of the population. It is apparent that all these business leaders have come to realize that a number of the changes we have seen during the pandemic will be here to stay. And the ways of the past may no longer be sufficient to navigate the future.

So how are businesses responding and preparing for a different but hopefully a better post-pandemic reality?

Our businesses are investing for the future.

CEOs have definitely risen up to the challenge. More than 74% of the CEOs planned to increase their investment in digital transformation.

The pandemic has forced businesses to accelerate their digitization plans and technology has rescued us from going back into the dark ages. CEOs will continue to invest in technology and in what many would call responsible digitization.

Cyber resilience

As businesses have moved online, CEOs are also looking to increase investment in cyber resilience. The threats of cyberattacks and breach of data privacy laws have never been greater, and the CEOs are strengthening their defenses against such threats.

Of course, technology will not properly run without upskilling the people who will use it. However, the push towards digitization will only favor highly trained people.

Opportunities will be fewer for those who cannot adjust and who are not able to adapt to the new technologies.

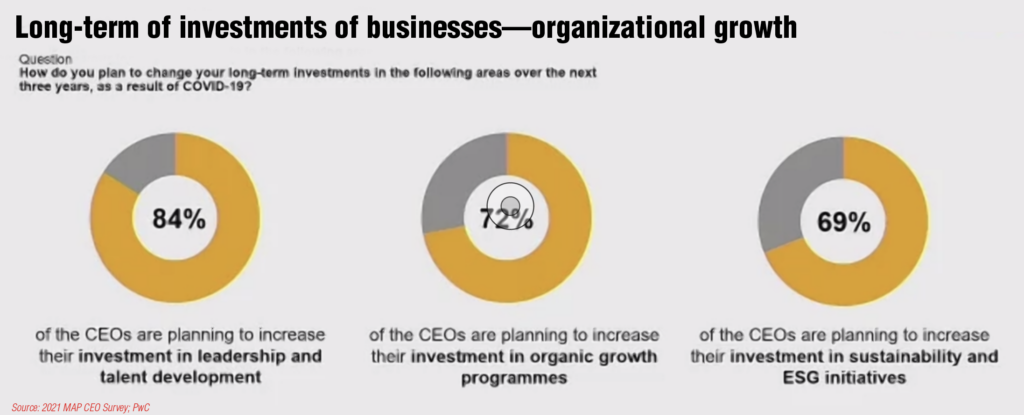

A staggering 84% of our CEOs are planning to increase their investment in leadership in talent development. As important as technology is during the pandemic, human creativity and tenacity is even more critical and our CEOs know that.

We have heard earlier about the Edelman Trust Index and an overwhelming number of respondents in that survey believed that it is the responsibility of businesses to re-train and upskill workers whose jobs are threatened by automation.

Goal is to build something better

The goal of most business leaders is not to go back to how business was done pre-pandemic but to build something better.

On that note, more than two-thirds of the CEOs are also looking to increase spending in sustainability and ESG initiatives.

And in the last 18 months, we have had fascinating conversations with our clients about sustainability. And while this conversation was primarily centered on the environment and climate change, it is encouraging to see that businesses are going in the right direction.

Climate change much bigger challenge

The pandemic may seem like the most urgent thing that we need to address at the moment, that climate change will be a much bigger challenge, particularly so for the Philippines which is ranked in the Top 3 to be most affected by climate change. And COVID-19 has given us the opportunity to pause and think about our priorities.

Hopefully, it has given the environment its a much-needed break as well.

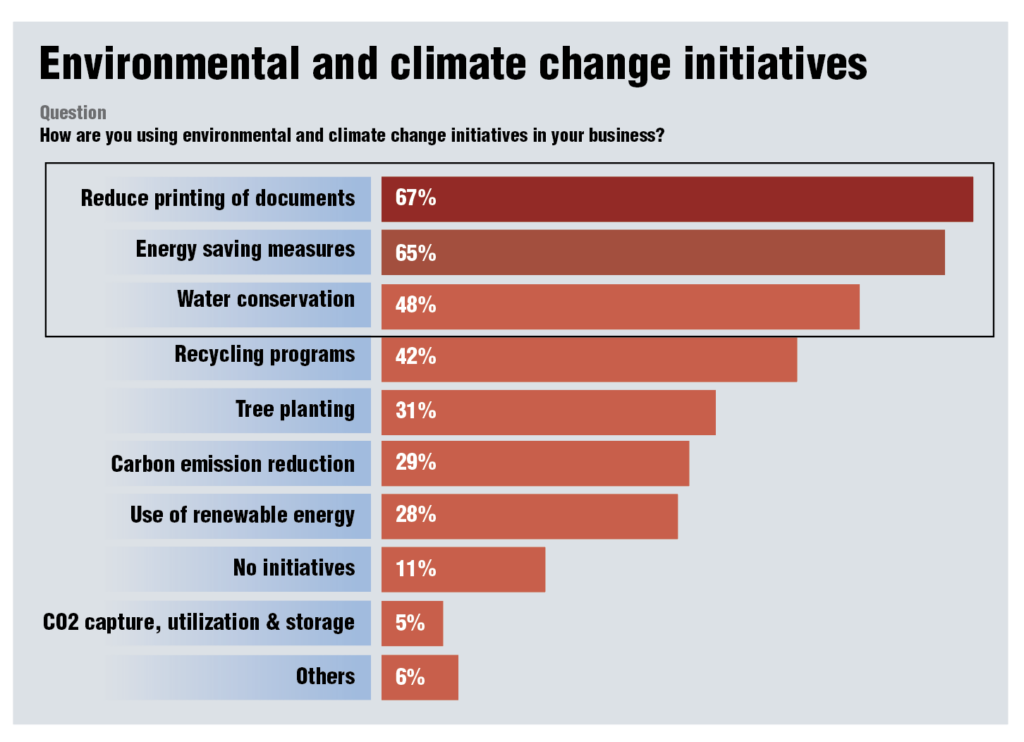

However, when we drilled down on the environmental initiatives of various businesses, only a few CEOs said that they tracked their carbon emission and making a deliberate effort in reducing their carbon footprint.

Most of the businesses as shown in the survey still have limited climate change initiatives and these are mostly focused on the area of reducing paper, energy, and water consumption.

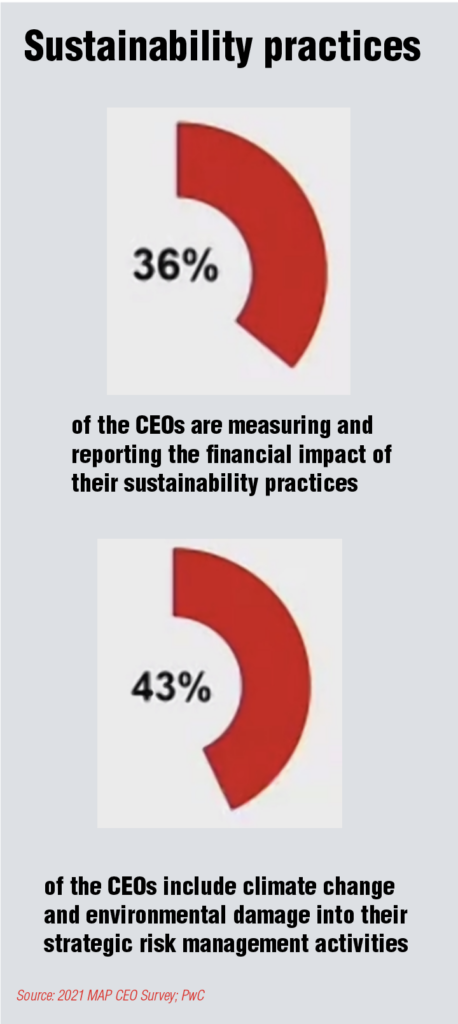

Sustainability practices

And only 36% of the CEOs said, that they measure and report the financial impact of their sustainability practices. This is also limited to mostly large corporations and those which are publicly listed.

Only a few MSMEs have responded on the positive. Also, only 43% have included climate change and environmental damage in the strategic risk management activities.

As more regulations are put in place, we will see more businesses incorporating ESG and climate considerations into their corporate synergy.

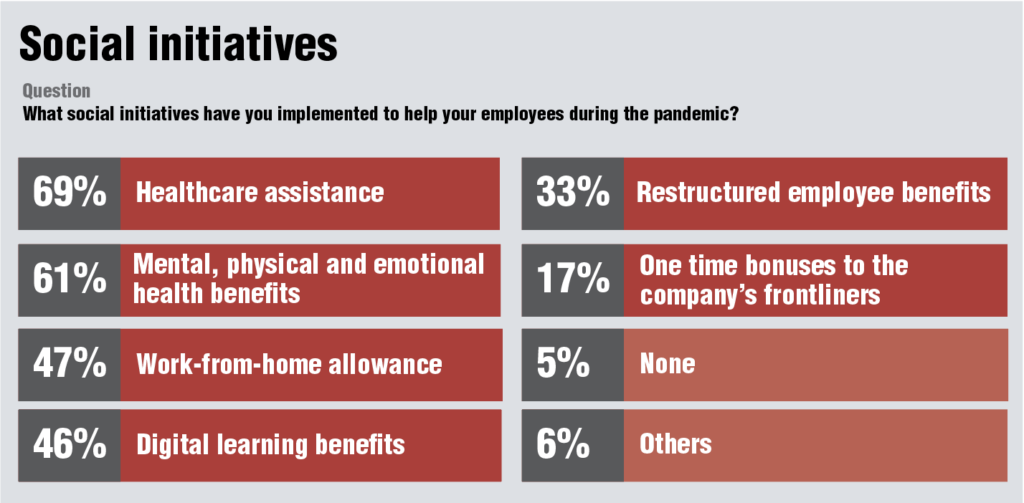

On social initiatives, businesses have focused on providing health care assistance and medical benefits to their employees. Some have already adjusted the compensation structure to incorporate remote working or flexible working arrangements.

Businesses have also revisited their governance policies, including tax compliance.

However, there is still a long way to go for businesses to incorporate ESG in management KPIs.

ESG is far too important and it needs to be driven from the top. There is a need to take this out from the corporate social responsibility initiatives and incorporate it into the overall corporate strategy.

Ethical consumerism

As we see customer behavior and expectations involve, there will be a demand for change. Ethical consumerism is on the rise and customers will vote with their wallets.

Customers will choose to support companies and brands that they believe are aligned with their values.

Investors will demand that their investee companies are ESG compliant while employees will be attracted to work from companies that they can be proud of.

So, companies are expected not just to respond to the needs of their shareholders but to the wider network of shareholders.

The past year and a half have been no less traumatic for most businesses but what COVID-19 has given us is the realization that if we work together, not only do we have the capacity for change but we have the incredible ability to drive change.

And judging from the responses of the CEOs from this year’s survey, we can clearly see the resilience of the Filipino spirit and we remain to encourage and hopeful for what’s to come.