Of all Philippine presidents, Rodrigo Duterte is the most tax-reform oriented. That’s good. Why?

Because tax avoidance (which is legal but is subject to so much graft) and tax evasion (which is illegal and is subject to even more graft) are among the biggest of Philippine industries.

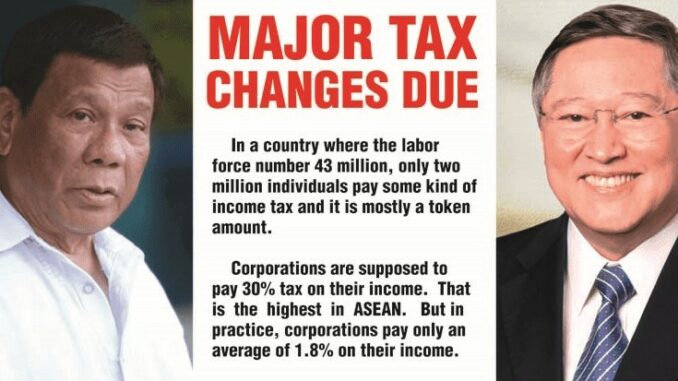

In a country where the labor force number 43 million, only two million individuals pay some kind of income tax and it is mostly a token amount.

The leakage is so huge that President Duterte is now thinking of gross income taxation, like what they do in Hong Kong. If your gross income is say P100, pay only P15 of that. No more cumbersome tax deductions and tedious paperwork. And no more side income to BIR personnel.

The Philippine GDP (value of goods and services produced in a given year) is P17.422 trillion. That’s value added and should be taxed at least 12%. Only P1.96 trillion was the tax collected, or 11.25%.

Corporations are supposed to pay 30% tax on their income. That is the highest in ASEAN. But in practice, corporations pay only an average of 1.8% on their income.

Why? No. 1, is graft. No. 2, the government is very liberal with incentives, especially to big businesses. In the past three years, the state gave away P1 trillion to private business for all kinds of tax incentives and perks.

At P3 million to create one job, P1 trillion could have created 333,333 jobs and contributed to more social stability and income equality, and of course, Duterte’s popularity rating rising above 100%.

Put another way, the P1 trillion could have financed two subway systems for Metro Manila by today.

In 2017 alone, the Department of Finance estimates P441 billion in foregone tax revenues—money that could have built, per DOF, 33,000 public markets, or 46,000 kms of roads, or 130,000 day care centers, or 450,000 classrooms. In other words, the money could have improved the quality of the Filipino— our human capital, which is our most important resource.

The generous tax incentives did not make the Philippines an export powerhouse. Nor did it lower Philippine unemployment. The average ASEAN unemployment is 4.1% (2017). Philippine unemployment is 5.7%, the highest in ASEAN.

The incentives went only to very few companies –3,150.

Contrast that with one million small enterprises who receive no incentives, whatsoever, and are in fact, subjected to all kinds of red tape and corruption.

Who are the 3,150 companies? Name any big Philippine corporation or a marquee multinational. Chances are they are being fed tax breaks by the Philippine government.

Of those 3,150, 1,169 have been receiving tax incentives for the last 10 years. It is like a baby who has never grown up and is being continually fed with tax incentives and instead of being allowed to wither away like everybody else.

So Duterte is mad. Finance Secretary Sonny Dominguez and his Usec Karl Kendrick Chua are mad. Albay Rep. Joey Salceda, chair of the House Ways and Means Committee, is mad. They all want tax money, your money, our money, put to good use.

The plan is to give companies inside the more than 500 export processing zones and receiving tax incentives for the last 10 years, to enjoy only two more years of tax incentives. After that, they will be treated like ordinary corporations not given special incentives. Tax incentives will now have an expiry rate—seven years at the most. After a review by a body called FIRB (Fiscal Incentives Review Board), the incentives could be renewed but that will be like passing thru the eye of the needle.

Companies should not worry, however. The government will still be liberal with tax money.

Corporations will pay less income tax, from 30% at present, to just 20% over a ten-year period. The rich will pay less on their wealth and landholdings if they list their companies in the stock exchange. The stock transfer tax will be reduced to just 0.1%, from 0.60% at present.

In the old days, the rich people would have paid as much as 60% on inheritance transferred to the next generation.

The government will reduce tax on so-called passive income, which is income you earn while sitting on your ass. Like capital gain or the appreciation in the value of your property. It is already 15% but DOF still thinks that’s high because the ASEAN average is supposedly 14.3% and that’s because Singapore and Malaysia have zero tax on capital gains.

The poor currently pay 20% tax on interest income earned on their local bank deposits. The rich deposit their money abroad where the tax is zero to 15%. So the plan, to make the poor happy, is to reduce the tax to 15%. Big deal.

The Duterte administration’s previous attempts at tax reform had serious consequences. The tax on diesel was raised from zero per liter to P4.50 and it triggered an 11-year high inflation.

Rice importation and rice regulation were removed from the graft-ridden and incompetent state-owned National Food Authority. Private companies were allowed to import rice, without limits.

So they imported 2.2 million tons in six months. This depressed the price of palay at the farm, to as low as P7 per kilo. The floor should have been P12 per kilo for the farmers to make money. Despite the drastic drop in palay prices, the price of rice in Manila markets went down only slightly, by P2 per kilo. Both the rice farmer and the rice consumer were hurt. Only the rice traders made money.

To fight the greedy rice traders, Duterte is ordering town and city mayors and provincial governors to go on a rice buying spree, with loans coming from Land Bank. The rice will be sold to their constituents at cheap prices. The loan will be repaid from the internal revenue allotment (IRA) of the LGUs, which IRA amounts to P800 billion a year.

— Tony Lopez