The P1.186-trillion (gain in deposits and bank borrowings) in the first half exceeded the banking system’s increase in total loan portfolio of P931 billion—meaning the banks didn’t release all of the additional money they got from the public (deposits) and lenders (borrowings). For every P5.34 of additional deposits and borrowings, the banks’ owners put in only P1. In effect, the banks contributed just P15.77 in equity for every P100 of liabilities. That’s a ratio worse than what the banks require of their borrowers—25 for every 100.

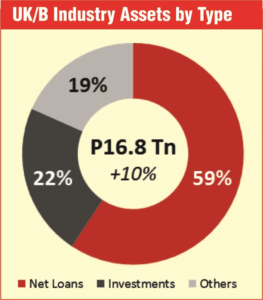

Total resources of the Philippine banking system (45 commercial banks) grew by a hefty P1.5 trillion or 10% to a record P16.8 trillion during the first half of 2019 ended June 30, 2019. The 10% growth is almost double the 5.5% gain in the total output of goods and services or Gross Domestic Product (GDP) during the period, January-June 2019.

This implies that banking remains a strong industry despite a seeming economic slowdown. Banking’s growth rates in the first half were in double digits.

Banking business is awesomely profitable. Return on equity (at the parent bank level) is 9.87% in June 2019, up from 9.35% in June 2018 and 9.64% in March 2019. The 9.87% ROE is more than three times the June inflation rate of 2.7%, for a net gain of 7.17%. For each P100 of stockholders’ money, the banks made a profit of P9.87. With inflation, the real gain was P7.17.

Most profitable

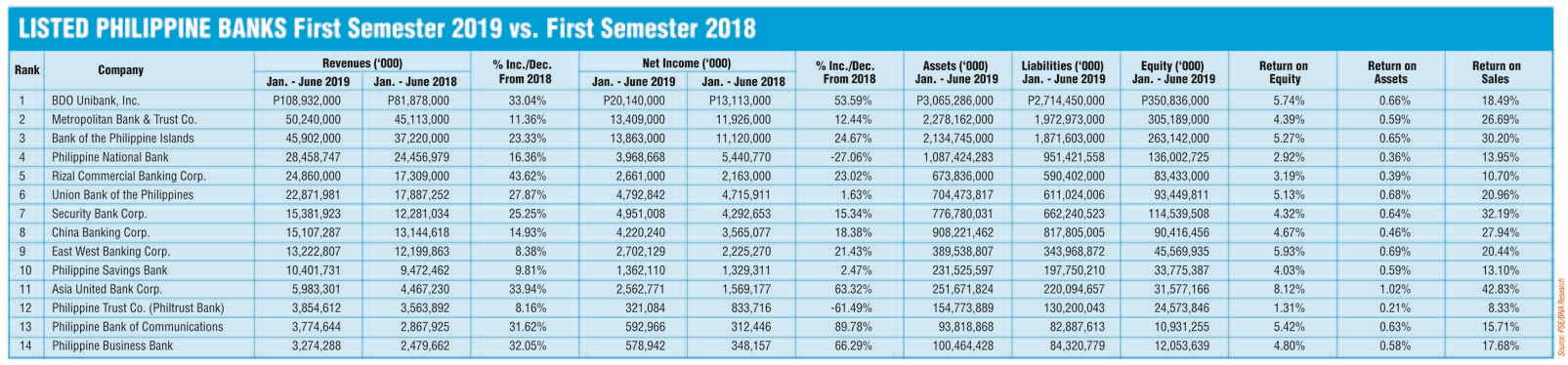

Among the most profitable banks are: East West Bank (EWB) 12.10% ROE; BDO Unibank (11.71%), and Union Bank (10.91% )

The banking system’s liquid assets grew 10% (P561 billion), total investment in securities by 19% (P604 billion), total loan portfolio by 10% (P931 billion), and net customer loan portfolio by 10% or P869 billion.

The banking expansion was financed mainly by borrowings as deposits grew by only single digit or 6% (P697 billion). Equity grew 13% (P222 billion). This implies that the country’s big banks are growing, not because of the money put in by their owners, by the money of the public (deposits were up P697 billion or 6%), and by lenders or creditors, P489 billion or up 13%, or a deposits and borrowings combined of P1.186 trillion.

The Golden Rule

This P1.186 trillion exceeded the total loan portfolio of P931 billion, meaning the banks didn’t release all of the money they got from the public (deposits) and lenders (borrowings). For every P5.34 of deposits and borrowings, the banks’ owners put in only P1. In effect, the banks contributed just P15.77 in additional equity for every P100 of additional liabilities. That’s a ratio worse than what the banks require of their borrowers – 25 for every 100.

So you can say banks follow the Golden Rule – he who has the gold (the banks) make the rules. They are aided in this scheme by the complacent Bangko Sentral.

Bank borrowings expanded by a remarkable 47% or P489 billion to P1.53 trillion, slightly higher than the P1.5-trillion growth in assets of the system.

The banking system had P12.525 trillion of deposits of as of June 2019. To generate that much in deposits, the banks deployed only P1.932 trillion of equity. For every P100 of equity or stockholders’ money, the banks generated P648 in deposits or more than P6 of deposits for every P1 of capital.

The banks also had outstanding borrowings of P1.53 trillion against total equity of P1.932 trillion, a difference of P402 billion—the net amount the bank owners were risking to produce P16.843 trillion in assets (41.89 times net equity), P9.989 trillion in loans (24.8 times net equity), P12.523 trillion in deposits (31.15 times net equity).

Put another way, for every P1 the bank owners invested in their banks, they generated P42 of assets, P25 of loans, P12.50 of deposits. No other business can generate so much in resources and leverage so much in liabilities for very little money invested by its owners.

Despite such massive undercapitalization, the banks have very low possibility of incurring losses thru bank loans. The gross non-performing loans ratio (parent bank level) is 1.56% — only P1.56 of every P100 in money lent out has a chance of not being repaid. To think that the 1.56 is already a deterioration. In June 2018, the npl was 1.33%.

Bankers are billionaires

Of Forbes’ top 20 Filipino billionaires, at least six families are bankers: that of Henry Sy (the richest family, which owns BDO), John Gokongwei Jr. (Robinsons Bank), the Ayala family (Bank of PI), Lucio Tan (PNB), Aboitiz family (Union Bank), Ramon Ang (Bank of Commerce), and the late Andrew Gotianun (East West Bank).

This report covers 45 universal and commercial banks, including Chang Hwa Commercial Bank and CIMB Bank which started local operations in July and December 2018, respectively.

June 30, 2019 versus June 30, 2018 asset accounts

Asset accounts

Among the top 10 banks, PNB recorded the fastest growth (+24%), which mostly came from investment securities (+68%) and net loans (+20%), particularly the commercial and SME segments. China Bank logged the second fastest growth (+18%), while BPI posted the largest nominal increase of P229 billion (+12%). The top 10 banks accounted for 84% of industry assets.

· Investment securities went up 19% or P604 billion to P3.8 trillion, 61% of which came from HTM growth.

· FAFVPL grew 26% or P55 billion to P265 billion. PNB significantly increased its holdings by P22 billion. Aggregate growth of the top 10 banks’ portfolio was at 48% or P61 billion.

· AFS (including non-marketable equity securities) increased 21% or P181 billion to P1.1 trillion as RCB and BPI’s portfolio expanded almost 8x and 7x, respectively.

· HTM increased 18% or P367 billion to P2.4 trillion from substantial additions in the portfolio held by LBP (+P103 billion), China Bank (+P59 billion), Philtrust (+P46 billion) and Union Bank (+P43 billion).

• Consolidated Net Loans expanded to P10 trillion (+10% or P931 billion). Customer Loans, which exclude RRP & IBCL, increased by 10% to P9.3 trillion on a net basis and to P9.4 trillion on a gross basis. China Bank’s net loans grew 17% to P536 billion while its customer loans growth rates on net and gross bases were at 16% and 15%, respectively, better than industry average.

Deposits

· Deposit liabilities recorded a minimal uptick of 6% or P697 billion to P12.5 trillion supported by the P46-billion LTNCD aggregate issuances. Seven out of 10 banks recorded single-digit growth rates while PNB (+P103 billion) and China Bank (P97 billion) expanded by 15%. Meanwhile, Union Bank is the only major bank which recorded a decline (-5% or P24 billion).

· Bank borrowings climbed a hefty 47% or P489 billion to P1.5 trillion with the issuance of P177 billion peso-denominated bonds of major banks.

Metrobank borrowings

Metrobank still recorded the highest borrowings at P270 billion. Despite its issuance of P46 billion peso bonds in November and December 2018 and April 2019, total MBT borrowings was up by only 5% or P14 billion after the redemption of P16 billion worth of Basel III Compliant Tier II Notes last May.

PNB’s borrowings significantly increased by P96 billion or 228% with the issuance of P13.87 billion worth of fixed-rate peso corporate bonds in May and Euro Medium Term Note worth $750 million in June.

On top of their bond issuances, higher Bills Payable drove up the borrowings of BPI, UBP, and RCBC.

· Equity grew 13% or P222 billion to P1.9 trillion from P1.7 trillion. PNB raised P12 billion via Stock Rights Offerings in April 2019 while RCBC and UBP raised P15 billion and P10 billion, respectively, last year.

Contingent accounts

· Volume of trust assets under management grew 14% or P401 billion to P3.4 trillion in June, P200 billion and P96 billion of which was accounted for by BDO and BPI’s growth, respectively. BDO maintained the largest industry share at 37%.

Financial ratios harmed by Hanjin bankruptcy

· Gross NPL Ratio (Parent) went up to 1.6% from 1.3% and Gross NPL Coverage ratio declined to 113% from 144%.

The deterioration in asset quality may be due to the loan exposures (aggregating to $412 million) of five banks to Hanjin. RCBC and Land Bank have the largest exposures at $140 million and $80 million, respectively while Metrobank has $72 million and BDO and BPI has $60 million each.

Among the top 10 banks, only PNB (-16 bps) and China Bank (-13 bps) recorded an improvement in Gross NPL ratios, while RCBC and Land Bank scored the biggest uptick of 151 bps and 84 bps, respectively.

Notably, the Gross NPL Coverage ratio of SECB fell to 128% from 272%, as well as, Metrobank’s to 155% from 231%. China Bank’s Gross NPL volume was flat year-on-year, resulting in the lowest Gross NPL ratio of 0.68% and the highest Gross NPL Coverage ratio of 254% among major banks.

· Customer Loans to Deposit Ratio (Consolidated) increased to 75% from 73%.

· Return on Equity (Parent) went up to 9.87% from 9.35%. BDO posted the largest improvement of 388 bps, followed by Chinabank with 247 bps. EWB has the highest ROE of 12.10% among major private banks, followed by BDO (11.71%) and UBP (10.91% ).

Capital adequacy ratio

· The industry remained well-capitalized with Total CAR at 15.78% on a consolidated basis and 15.06% on a solo basis in March 2019.

As of June 2019, Security Bank recorded the highest total CAR ratio among the top 10 banks at 19.2%, followed by Metrobank with 17.1%.

— With files from China Bank