The Philippines is one of the most attractive markets in Asia. It expected to sustain its strong momentum to remain the fastest growing economy in Southeast Asia from 2017 to 2022.

Household consumption expenditure contributes to 73.5% of GDP, and is well supported by a sizeable population which is the fastest growing in the region and the 12th largest on earth.

Consumption-driven economy is well supported by favorable demographic trends. Foreign direct investment inflows have been increasing and this is reflective of investors’ confidence in the Philippines given the country’s favorable macroeconomic fundamentals.

A large, youthful and growing population

The Philippines is a large market with a population of 105 million as of 2017 according to the Philippine Statistics Authority.

The Philippines is a large market with a population of 105 million as of 2017 according to the Philippine Statistics Authority.

This is the second largest population in Southeast Asia, next to Indonesia, and is also the fastest growing. The Philippine market is relatively young, with a median age of 24 years, which is the lowest among the Southeast Asian countries.

From a gender split, the population is quite evenly distributed: 50.2% are male and 49.8% are female.

The Southeast Asian market for alcoholic beverages stood at 6.1 billion liters in 2017, with the Philippines as the largest market, accounting for 46% of the total volume in the region.

Strong economic growth leading to increasing disposable incomes and an overall willingness to spend has been an important driver and will continue to be key for growth.

Fastest growing economy in the region

Philippine’s nominal GDP reached $295 billion in 2017, implying a CAGR of 8.8% from 2015 to 2017. Real GDP also posted robust growth of 6.8% CAGR during the same period, driven by strong consumer spending which, in turn, was fueled by sustained overseas income remittances and earnings from business process outsourcing services, as well as low unemployment.

Foreign direct investment inflows have been increasing and this is reflective of investors’ confidence on the Philippines given the country’s favorable macroeconomic fundamentals.

The Philippine economy is expected to sustain its growth momentum and remain the fastest growing economy in Southeast Asia from 2017 to 2022F.

Real and nominal GDP are projected to expand by 6.8% and 9.2%, respectively, during this period, according to GlobalData.

Underlying drivers for robust growth, such as increasing propensity for consumption and continued population growth with favorable demographics, remain compelling.

Growth will be further boosted by increases in private construction and infrastructure spending as well as expansion in the country’s manufacturing and services sectors. Increased overall economic activity is expected to create more jobs and income opportunities in the country.

GlobalData expects employment to further improve with more than four million people expected to join the workforce from 2017 to 2022F, and unemployment rate to decrease further from 6.3% in 2017 to 5.5% in 2022F.

Regions outside the Greater Manila area are expected to benefit from development activities such as infrastructure spending and growth of business process outsourcing.

On a per capita basis, nominal GDP per capita in the Philippines has been increasing at a CAGR of 7% from 2015 to 2017, reaching $2,821 in 2017.

As the economy continues to grow, nominal per capita GDP is projected to continue to grow at 7.5% from 2017 to 2022F and this will be further driven by consumer spending in the country.

Luzon has 72.2% of GDP

Luzon including Greater Manila, accounted for 72.2% of the Philippine’s GDP and 56.5% of the population in 2017, while the Visayas and Mindanao region accounted for 27.8% and 43.5% of GDP and population respectively, reflecting differences and disparities between the two regions. In 2015 to 2017, Luzon including Greater Manila, experienced a GDP growth of 8.5%, while the Visayas and Mindanao region experienced a GDP growth of 9.7% in the same period.

Luzon including Greater Manila, accounted for 72.2% of the Philippine’s GDP and 56.5% of the population in 2017, while the Visayas and Mindanao region accounted for 27.8% and 43.5% of GDP and population respectively, reflecting differences and disparities between the two regions. In 2015 to 2017, Luzon including Greater Manila, experienced a GDP growth of 8.5%, while the Visayas and Mindanao region experienced a GDP growth of 9.7% in the same period.

According to GlobalData, Greater Manila will continue to be a lucrative market with higher levels of income driving growth of premium and specialized products. Luzon is also expected to record rapid economic growth in the next few years, driven by government plans to unleash the potential of Northern and Central Luzon by improving infrastructure, and private sector initiatives.

Rising employment rates will also increase purchasing power for these regions.

The Philippines is poised to benefit as development spreads to regions outside Greater Manila, particularly the rest of Luzon Visayas, and Mindanao. Visayas and Mindanao, which are comparatively less wealthy regions, present abundant opportunities for growth and development. Robust economic growth is expected to be supported by a growing tourism and service industry as well as government initiatives to eradicate poverty and improve infrastructure.

GlobalData expects the urban population to expand by more than four million in the coming years to account for 44.4% of the population.

Key consumption trends

Complex geography

The Philippines is composed of over 7,000 islands and has relatively underdeveloped infrastructure in some parts of Luzon, and the Visayas and Mindanao regions. These conditions make nationwide transportation and distribution of goods highly complex and expensive.

This also creates a significant challenge to entry for potential new players in the market without an established distribution network.

The lack of sufficient cold storage facilities create further obstacles for businesses and industries that have such requirements, such as dairy and fresh meats.

A gradual improvement in infrastructure, supported by the government, along with an increase of modern trade outlets will widen the market and consumption growth of these products.

Demand for ‘value for money’ products

According to GlobalData, the majority of Filipinos in regions such as Davao earn minimum daily wages of P370 ($6.92) compared to Metro Manila’s P502 ($9.38) per day outside of Metro Manila.

Accordingly, large segment of the population is highly value-conscious and seeks affordable options that balance price with quality.

This trend is evidenced by the high popularity of mainstream beer compared to premium options, and locally manufactured spirits compared to branded imported variants.

Manufacturers are therefore offering products specifically targeting these consumers. For example, SMFB offers ‘super saver’ packs of meat cuts, and likewise carries value-for-money beer labels like Gold Eagle beer (which costs P25 ($0.47) for a 320ml bottle) and Red Horse beer (which costs P78 ($1.46) which has a stronger alcohol content).

Demand for variety

Consumers in the Philippines are looking for greater variety in their food and beverage products, seeking brands that provide them with new and exciting experiences.

According to a GlobalData survey, 43% of respondents stated that they enjoy experimenting with new and unusual flavors in alcoholic beverages. This trend is further supported by a large youthful population base in the Philippines.

Young consumers are generally variety-seekers and look for products that provide them with optimum sensory experiences.

According to GlobalData, 44% of respondents within the age of 18 to 24 stated that flavor is very influential when choosing what alcoholic beverage to consume, as compared to only 17% for the 45 to 54 age group.

To capture this trend, food and beverage manufacturers are developing new products with novel and experiential flavors as well as innovative packaging to appeal to these consumers.

The alcoholic beverage (beer and spirits) industry

The Philippine’s youthful population and established drinking culture are expected to support growth momentum.

Based on a survey of GlobalData, 45% of respondents between the ages of 18 to 24, and 54% of respondents between the ages of 25-34, stated that they drink alcoholic beverages regularly.

There is also a growing acceptance of women drinking socially, with 46% of surveyed female respondents in 2017 stating that they drink alcohol.

The alcoholic beverages market value in the Philippines grew at a 14% CAGR from 2015 to 2017, and is expected to grow at a CAGR of 7.3% from 2017 to 2022F.

This growth potential is also supported when comparing the Philippine’s significantly lower per capita consumption of alcoholic beverages against mature markets such as the US.

In the Philippine alcoholic beverages market, beer accounted for more than 71.7% of the total alcoholic beverage volume in 2017, with the balance distributed across different types of spirits, predominantly rum, gin, and brandy.

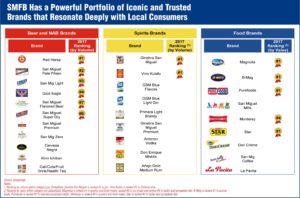

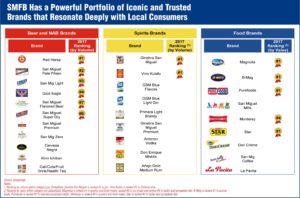

Based on GlobalData, the top alcoholic beverage brands by volumes include Red Horse, San Miguel Pale Pilsen, Emperador, Ginebra and San Mig Light.

Key market trends

Increasing number of multi-beverage drinkers

An increasing number of consumers in the Philippines are drinking multiple types of alcoholic beverages instead of just one.

As economic development and industry growth allow regional distributors to deliver a greater variety of products to consumers, the different product segments within the alcoholic beverages industry are expected to grow simultaneously.

This trend presents an upside scenario for manufacturers such as GSMI and SMB, both of which are diversified in their product offerings, and are therefore well positioned to capture growth across multiple types of alcoholic beverages.

Youthful and affluent Filipinos seeking new and differentiated experiences

The large population of young people in the Philippines combined with their growing affluence and high willingness to spend makes young drinkers a key consumer base of the industry.

Key producers are recognizing the importance and have been targeting this segment with new product launches and innovative promotional campaigns. For instance, SMB launched the first flavored beer in the market to target the younger segment and the brand has performed extraordinarily well since its launch in 2010.

Marketing has also expanded beyond traditional platforms to reach into the digital space such as SMB’s ‘Game Tayo’ mobile app of mini games, as well as through pop culture such as sponsoring popular sports teams, as SMB had done with San Miguel Beermen basketball team.

The beer industry

The Philippine beer market was valued at $2,983 million in 2017. In terms of volume, this totaled 1,997 million liters, accounting for 22.6% of the Southeast Asian beer market.

According to GlobalData, the Philippines has a relatively low per capita beer consumption when comparing to other mature markets such as the US, which implies potential for growth which will be supported by a strong increase in income levels.

The value of the beer market is projected to grow at a CAGR of 9% for 2017 to 2022F, while volumes for the same period are expected to grow at a CAGR of 6.5%.

In view of the favorable market prospects, domestic and international beer players have announced plans to take advantage of beer market opportunities in the Philippines. In 2017, SMB – the largest beer producer in the country by volume – announced an expansion plan for a new plant. Similarly, Heineken International B.V. ABHP entered the Philippines through a joint venture with Asia Brewery Inc. in [2016] to capture market opportunities especially in the premium and mainstream segments.

Regional breakdown

Regionally, the biggest consumer of beer is Luzon including Greater Manila, which accounts for 72% of the total volume in 2017.

According to GlobalData, the region’s volume is projected to grow at 6.6% CAGR from 2017 to 2022F. It is expected that beer consumption in 2022F within Luzon including Greater Manila, will reach 1,980 million liters. From a value perspective, the region accounted for $2,198 million of the total market size in 2017 and is expected to grow at a CAGR of 9.4% from 2017 to 2022F.

By 2022F, the value of the market size in Luzon including Greater Manila will reach $3,451 million. Growth in the next few years will mainly be driven by improving economic prosperity in Greater Manila, Luzon’s anticipated economic boom, and urbanization increasing opportunities for both on-trade and off-trade consumption.

Visayas and Mindanao accounted for the remaining 28% of the market in terms of volume in 2017. According to GlobalData, the region is expected to grow at a higher rate of 6.4% over the same period on a volume basis.

This will mainly be driven by economic improvements led by rising tourism and growing employment rates, both of which are supported by key government and private sector initiatives targeting West Visayas, and infrastructure programs in Mindanao, respectively.

On a value basis, the regions account for 26.3% of the total market in 2017, implying a higher contribution of lower priced products. This is projected to grow at a CAGR of 7.6% from 2017 to 2022F, to reach $1,134 million by 2022F.

Beer segment breakdown

The beer industry in the Philippines can be broadly broken down into four specific segments: Economy (≤P25 ($0.47) per bottle), Mainstream (P26 to P40 ($0.49 – 0.75) per bottle), Premium (P41 to P60 ($0.77 – 1.12) per bottle), and Super Premium (>P60 ($1.12) per bottle).

The Mainstream segment is the most dominant segment nationally, as well as across each region.

The Economy beer segment accounted for around 9% of total sales volume in the Philippines in 2017, and 80.4% of the volume is consumed in the Visayas and Mindanao regions.

Economy beer is widely available to the masses, usually sold in glass bottles in mom and pop stores, small supermarkets, and on-premise channels. Consumers in this segment are usually more value-conscious and hunt for bargains.

Notable brands in the segment include Gold Eagle and Beer Na Beer. Decreasing volume in the coming years can be attributed to the growing economic prosperity as consumers begin moving towards beers in more expensive price segments.

The Mainstream segment accounted for 88.6% of total sales volume in 2017, and is expected to continue growing in the next few years. Growth will be driven by the growing economic prosperity across the Philippines, especially as consumers in the country begin to trade up. Leading brands in the segment include Red Horse, San Miguel Pale Pilsen, and San Mig Light.

The Premium segment represents 1.7% of total sales volume in 2017. Products in this segment are mainly targeted towards consumers in urban areas such as Greater Manila, which accounts for a significant portion of the market.

Although the segment has a low base, the segment’s strong growth in the next few years will be driven by urban consumers’ increasing sophistication and evolving palate for high quality ingredients.

This segment is expected to represent 3.9% of the market value by 2022F. The market is largely divided between products brewed locally such as San Miguel Super Dry and foreign brands such as Tiger and Heineken.

The Super Premium segment represents the remaining 0.7% of volume in the Philippines and is mainly represented by imported and local craft beers.

Distribution is limited to confines of upscale hotels, bars, restaurants, and supermarkets mainly within Metro Manila, targeting urban consumers with relatively high purchasing power as well as tourists.

Distribution of beer

Beer distribution covers large modern supermarkets, smaller supermarkets, convenience stores, gas stations, and mom and pop stores as well as on-premise channels such as bars, clubs, hotels, and restaurants.

Currently, off-trade beer accounts for 58.4% of sales value in the Philippines. Brewers distribute to retailers mainly through a network of independent, exclusive dealers. In the provinces, these dealers work with a large number of sub-dealers and wholesalers.

The RGB (returnable glass bottle) enjoys widespread distribution across all channels as it is popular with consumers.

For example, the leading brand Red Horse costs P78 ($1.46) for a one-liter RGB with a P4.50 ($0.08) deposit on the bottle when purchased from mom and pop stores.

RGB can be used for multiple manufacturing cycles depending on the quality of the glass used to make the bottles.

Competitive landscape

The Philippines’ beer market is led by SMB with a leading market share of 92.7% of volume, distributed amongst its portfolio of beer brands, including, Red Horse, San Miguel Pale Pilsen, San Mig Light, and San Miguel Flavored Beer.

AB Heineken Philippines Inc. is the second main player in the market with 6.6% market share, comprised of its products Colt 45, Beer na Beer, Tiger, Heineken, and Brew Kettle.

Key market trends

Demand for increased specialized variety such as light, flavored and non-traditional brews

Filipino consumers’ openness for new and innovative beer flavors have led brewers to roll out innovative products that have novel ingredients or have low calorie content.

The San Mig Light and San Mig Zero are variants targeting consumers’ unique and less filling experiences. SMB also launched San Miguel Flavored Beer in apple and lemon flavors which are claimed to be smooth, light, and sweet.

This trend is particularly strong amongst youthful drinkers that value experience and seek specialized products, especially when socializing with friends. The San Miguel Flavored Beer has performed extraordinarily well since its launch in 2010.

Increasing interest for local and imported craft beer

Similarly, homegrown specialty craft brewers, as well as those from Europe and America, have started to launch products that offer new consumption experiences or claim to use natural, authentic, or regional ingredients.

According to a GlobalData survey, 61% of respondents would like to see more craft offerings in the market. The craft movement is spreading across the various regions and according to the Philippine Craft Beer Community, there were 12 craft brew pubs and 24 micro/nano breweries as of 2017. However, these products currently only account for a small portion of the market.

Rising premiumization and indulgence

With evolving palates, consumers in the Philippines increasingly demand sophistication. These consumers are highly demanding and often seek specialized products for indulgent experiences as opposed to mundane mass offerings.

This trend is driving manufacturers to offer unique and indulgent alcoholic beverages that cater to specific consumer expectations for exquisite experiences. SMFB targets said consumers with more sophisticated palates through its ‘artfully-crafted’ brands such as San Miguel Premium All Malt, Cerveza Negra, and San Miguel Super Dry.

Taxes and implications

Effective Jan. 1, 2017, a unitary tax rate of P23.50 ($0.44) per liter shall be imposed on all fermented liquors regardless of the net retail price (excluding the excise and value-added taxes) per liter of volume capacity, except those affected by the “no downward classification clause”.

The rate shall be increased by 4% every year thereafter, as prescribed by the provisions of RR No. 17-2012 dated Dec. 31, 2012. Excise tax rate effective Jan. 1, 2018 is P24.44 ($0.46) per liter.

The Philippine government also plans to implement tax stamps for alcoholic beverages, including fermented alcohol drinks in 2019 to tackle the rising issue of counterfeiting and illicit liquor trading. The move is also intended to ensure collection of excise duties.

The spirits industry

The Philippines spirits market reached a market size of $2,043 million and 787 million liters in 2017, accounting for 49.1% of the entire Southeast Asian spirits market by volume. The Philippines ranks second in the region on a per capita consumption basis with 7.5 liters, second to Thailand.

According to GlobalData, the Philippines spirits market is expected to continue growing in next five years, driven by favorable macroeconomic and consumption trends. The market’s value and volume are expected to grow at 4.8% and 3.1% CAGR respectively for 2017-2022F.

In 2017, Luzon including Greater Manila, contributed to 66.1% and 64.3% of the total value and volume of spirits sold in the Philippines respectively.

On a per capita consumption basis, Greater Manila is the highest with 10 liters, followed by Luzon with 8.2 liters, Mindanao with 6.4 liters, and Visayas with 5.8 liters. The higher consumption rates in Luzon including Greater Manila can be attributed to higher income levels and high urbanization.

According to GlobalData, while Luzon including Greater Manila, are projected to remain as the two largest markets for spirits, consumption levels in Mindanao and Visayas are expected to increase at a faster pace.

This is due to strong economic tailwinds, further bolstered by growing tourism and active government initiatives, including tax cuts and infrastructure development to increase regional prosperity.

Segment breakdown

The Philippine’s spirits industry is segmented by key categories, namely Gin, Chinese Wine, Brandy, and Rum & Others. Brandy is the largest segment on both value and volume basis, followed by gin. Gin accounted for 30.9% of the total market volume in 2017.

Gin

The gin segment is mainly consumed in Luzon including Greater Manila, which accounts for 94.9% of market value in 2017.

According to GlobalData, the gin market was valued at $597 million in 2017 and is forecasted to have a 7.6% and 5.7% CAGR, in terms of value and volume, respectively, for the period 2017 to 2022F.

In addition to attractive consumption trends driving overall growth of the spirits market, gin segment growth is also supported by its popularity amongst Filipino consumers.

As the Philippines gradually embrace the development of cocktails, gin manufacturers will benefit given gin’s flexibility and compatibility with other flavors.

Key examples include local cocktails such as ‘shembot’, which combines gin with coffee, ‘mountain gin’, which combines gin with Mountain Dew, and ‘C4’, which combines gin and apple iced tea.

As consumers gradually seek varied experiences with drinking gin, gin manufacturers will benefit from product launches that appeal to such preferences.

This will be especially beneficial for local manufacturers, as Filipino consumers place greater trust in local products.

In a GlobalData survey, as many as 36% of Filipinos responded that they associate high quality with food and drinks produced locally.

Chinese wine

According the GlobalData, the Chinese wine category accounts for 3.2% of the Spirits market value in the Philippines in 2017, and is expected to be the fastest growing segment in the spirits industry at 9.9% CAGR from 2017 to 2022F.

Chinese wine is mainly consumed in Visayas and Mindanao, accounting for 95% of the market in 2017. Segment growth will continue to be driven by these regions in the next few years.

Brandy, rum and others

The brandy segment is the largest spirits segment, accounting for 40.1% of the total market value. The segment recorded the slowest growth over the past three years, with a 2015 to 2017 CAGR of 2.5% for value and 1.3% for volume.

According to GlobalData, this segment is projected to underperform gin and Chinese wine, only growing at a CAGR of 1.5% and -0.3% for value and volume, respectively, from 2017 to 2022F.

Rum accounts for 23.2% of the market in 2017 and was the fastest growing segment in the past three years. GSMI launched its Anejo Gold Medium Rum in 2017 to capitalize on the growing popularity of rum.

However, this segment is expected to moderate going forward with a CAGR of 5% and 3.2%, by value and volume, respectively, from 2017 to 2022F.

Within this segment, there is strong demand for bold and new flavors, particularly amongst young consumers leading manufacturers to include ingredients such as spices.

These consumers with highly impressionable nature tend to seek brands that they can identify with, opening opportunities for celebrities and influencers to launch new brands that their fans can relate to.

Distribution of spirits

Off-trade channels such as supermarkets, convenience stores, and mom and pop stores accounted for 66.3% of total value sales in 2017.

Driven by a favorable drinking culture and social drinking emerging to be an important aspect for Filipinos’ quality time with friends and family, on-trade sales is expected to show considerable growth over the next few years.

Competitive landscape

Philippine’s spirits market is dominated by a few key players across major categories such as brandy, gin, rum, and Chinese Wine. GSMI is one of the largest players, supported by its strong and diverse portfolio of products. Core brands such as Ginebra and Vino Kulafu continue to lead the gin and Chinese wine categories, respectively.

Filipino consumers, especially those that are value-conscious, are often skeptical towards premium options. This preference has resulted in the high popularity of cheaper, domestically manufactured spirits, such as those of GSMI.

On a brand level, the top three brands are Emperador Light, Ginebra, and Tanduay which are the dominant players in the brandy, gin, and rum segments, respectively.

Over the past three years, Emperador Distillers’ brands (Emperador Light and Emperador) have been gradually losing market share, while GSMI’s brands (Ginebra and Vino Kulafu) have been gaining market share.

Although Tanduay Distillers’ brands have experienced relatively high growth, its brands remain to hold a smaller market share relative to the other two players.

Gin

GSMI led the gin segment with a volume share of 95.3% in 2017, and had continued to gain market share from its competitors over the last few years.

According to GlobalData, GSMI also benefited from consumers’ shift away from brandy to other spirits like gin and rum in the last few years.

Chinese wine

GSMI is the largest player in the Chinese wine segment with a market share of 64.5% by volume in 2017 through its Vino Kulafu brand. Other minor players in the industry include Uy Masuy Wine Factory Inc. and Destileria Limtuaco & Co. GSMI has been able to increase its market share substantially over the last few years, taking market share away from its competitors.

Key market trends

Demand for differentiated products with unique flavors and natural ingredients

Demand for differentiated drinking experiences has led spirits manufacturers to start creating new flavor notes and set up vibrant brand images to appeal to consumers.

For example, GSMI launched GSM Blue which include flavored variants, such as Mojito and Brown Coffee, to target this demand.

The GSM Blue brand has increased its market share in spirits from 0.28% in 2015, 0.30% in 2016, to 0.31% in 2017. Distillers have also appealed to health-conscious consumers by branding their products as “organic”, “natural”, or “pure”.

This is evidenced by the creation of spirits such as Green Life’s 45% ABC brandy, claimed to be organically made with coconut flower.

Experience-driven spirits consumption

The spirits market is highly dependent on young consumers who seek out new and exciting experiences across regions. This has fueled the rise of a cocktail scene, leading to the popularity of new local cocktails such as shembot, mountain gin, and C4.

Distillers are also making improvements to their formulations by adding sophisticated and sensory ingredients which justifies a higher price and makes the drinking experience more memorable.

According to GlobalData, 57% of respondents in a survey were willing to pay extra for alcoholic beverages that they feel will bring extra levels of enjoyment and indulgence.

Taxes

Effective Jan. 1, 2015, Republic Act No. 10351 imposed an ad valorem tax on distilled spirits equivalent to 20% of the net retail price (excluding the excise and value-added taxes) per proof and a specific tax of P20 ($0.37) per proof liter.

Specific tax rate effective Jan. 1, 2016 is P20.80 ($0.39) per proof liter, which shall be increased by 4% every year thereafter, as prescribed by the provisions of Revenue Regulations (RR) No. 17-2012 dated Dec. 31, 2012. Specific tax rate effective Jan. 1, 2018 is P22.50 ($0.42) per proof liter.

The Philippine government also plans to implement tax stamps for alcoholic beverages, including distilled alcohol drinks in 2019 to tackle the rising issue of counterfeiting and illicit liquor trading.

The move is also intended to ensure collection of excise duties.