In the battle for bigness in Philippine business the field has narrowed down to two groups, and only two – the beer, packaging, petroleum, power and infrastructure mega conglomerate San Miguel Corp. of Eduardo Cojuangco and Ramon S. Ang, and SM Investments Corp., the retailing, banking, and property conglomerate off taipan Henry Sy Sr.

So far, the SM Group seems to have an edge as the country’s most profitable company—but only slightly.

In terms of cumulative profitability in the last six years (2011 to 2016), SMIC has chalked up quite a remarkable record. The retailing, banking and property conglomerate has had cumulative profits of P188 billion.

In terms of cumulative profitability in the last six years (2011 to 2016), SMIC has chalked up quite a remarkable record. The retailing, banking and property conglomerate has had cumulative profits of P188 billion.

The P188 billion is P13.2 bllion or 7% higher that the combined profits of SMC of P174.79 billion during 2011 to 2016.

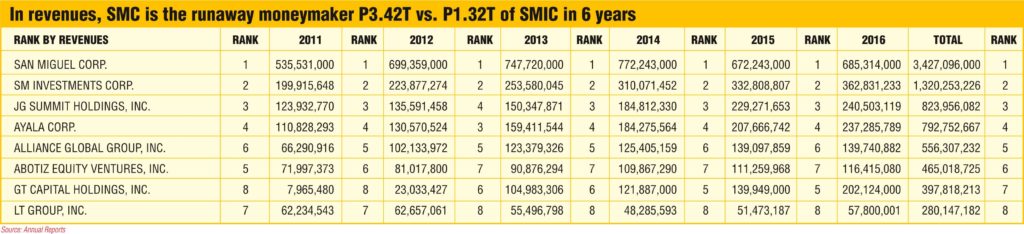

In terms of revenues, however, SMC is a proven money-spinner. Its combined revenues during 2011 to 2016 amounted to a whopping P3.42 trillion, P2.1 trillion or 160% more than that of SMIC, P1.32 trillion, during the same period.

Average SMC revenues in six years: P571.2 billion. Average SMIC revenues in six years: P220 billion. So San Miguel makes 2.6 times more revenues every year than SMIC.

Third in cumulative six-year revenues is JG Summit Holdings, the holding company of taipan John Gokongwei Jr.. It generated P823.9 billion sales during 2011 to 2016.

In profitability, two conglomerates are vying for a distant third place, Aboitiz Equity Ventures, Inc. of the Aboitiz family, which piled up P129.7 billion in profits from 2011 to 2016. Ayala Corp., the property, banking, and telco conglomerate of the Zobel-Ayala clan, had cumulative profits of P129.27 billion during the past six years.

In profitability, it has been a see-saw battle between SMC and SMIC. In six years, the score is 3-3.

In the past six years, SMC has been No. 1 in profits among all Philippine corporations three times – in 2012 (P37.65 billion), 2013 (P50.72 billion), and 2016 (P52.24 billion).

SMIC has been No. 1 in profits also three times – in 2011 (P30.19 billion), 2014 (P41.54 billion), and 2015 (P43.65 billion).

San Miguel was edged out of the profit game because in 2015, its profits were flat, P28.99 billion, from P28.57 billion in 2014, while SMIC recorded much higher net income the same year, P43.65 billion, a whopping P14.66 billion more than San Miguel’s.

SMIC’s edge in profitability over San Miguel maybe slight – just 7%, but the stock market gives the retailing, property and banking behemoth an astounding valuation – 24 times its profits, to value the company at P1,150 billion or P1.15 trillion, making it the country’s most valuable corporation.

On the other hand, San Miguel is valued by the market at only P244.88 billion, just five times its annual earnings.

SMC lags in overall six-year profitability by only 7% and yet SMIC is valued at 4.7 times more than San Miguel.

This may explain why Tatang Henry is the country’s richest individual.

Henry’s 67% control of SMIC yields a networth of P770.5 billion ($15 billion at P51 to $1).

SMC’s biggest individual stockholder, RSA, who controls 24%, is worth only P58.77 billion ($1.15 billion), The vice chairman president and chief operating officer is, of course, immensely richer, because of his 88.5% ownership of listed Eagle Cement which has a market cap of P73 billion, giving him wealth of $1.26 billion from his cement business alone.

That SMIC is valued 4.7 times more than San Miguel implies that the brewery, food, power and infra behemoth is grossly undervalued. It currently sells at only P102.80 per share.

“San Miguel should be worth P300 per share,” reckons Albay Congressman Joey Salceda, Asia’s top analyst before he joined public service as a congressman, Albay governor, cabinet member and now again, congressman.

Today, SMC is No. 1 beer, food, packaging, petroleum refining and marketing, power generation, and tollways. It is moving aggressively into mass transport, airports, coal, cement, hotels, resort and island development, even while expanding frenetically its core businesses – beer, food, packaging which are also market leaders.

In 2016, SMC’s businesses had combined EBITDA value of P1,051 billion. Beer and Ginebra are worth P307 billion, Food P116 billion, Packaging P46 billion, Power P124 billion, Fuel and Oil P317 billion, and Infra P141 billion.

RSA’s strategy is: SMC must diversify widely, clearly, and nimbly.

Accordingly, SMC leap-frogged upon the competition and undertook the largest diversification ever in more than 120 years. (The company was founded in 1890). In so doing, Ang redefined two business clichés – game changer and first mover advantage.

$30 billion revenues by 2020

Over the next three years, or by 2020, San Miguel hopes to achieve consolidated revenues of $30 billion and consolidated operating income of $5 billion. That implies a return on sales of 16% to 17% and growth in sales as well as profits averaging 25% per year between now and 2020.

Over the next three years, or by 2020, San Miguel hopes to achieve consolidated revenues of $30 billion and consolidated operating income of $5 billion. That implies a return on sales of 16% to 17% and growth in sales as well as profits averaging 25% per year between now and 2020.

Between 2008 and 2014, SMC revenues grew by an average of 60.8%, per year, while EBITDA (earnings before interest, taxes, and depreciation, grew by 57% clip per year.

Overcoming initial confusion about SMC’s frenetic moves, investors have begun to appreciate the strategic moves of Ramon Ang. Share price is up 13% to P104, from Dec. 29, 2016.

SMC’s expansion and diversification launched in 2008 have been so seamless and almost flawless SMC is a markedly different company today—bigger, better, more resilient, more competitive, and hugely more profitable.

Over the long pull, Ang wants to invest too in heavy industries – like steel mills (to cash in on industrialization) and heavy equipment manufacturing ala Caterpillar (to cash in on modernization of agriculture through greater processing of agricultural products), and the new Manila airport, in Bulacan.

Ang is a great philanthropist. SMC prices its products deliberately low. It routinely spends billions for landless farmers and the homeless. Recently, RSA gave P2 million each to the families of soldiers killed in Marawi.