The pandemic has become a rare opportunity for banks to be good, and to upscale from being good to being simply great.

Since banks are an invention of man, the pandemic is also an opportunity for great bankers to come forward to show their wares and contribute to helping solve the greatest problem of the century—the COVID-19 pandemic.

A good bank is PESO

What makes for a good bank? Or a great bank for that matter? Four letters –P, E, S, and O.

P is not the Philippine currency. P means people. More than any other time in the industry’s history, the pandemic opens almost limitless possibilities for being people-focused.

E is the environment. Climate change alters how we relate to other species. Global warming means animals, big and small, must move away from the heat. The loss of habitat due mainly to deforestation forces animals to migrate. The interaction among species which should normally be mixing opens possibilities of infections and pandemics. People who live in crowded places and areas with poor air quality are highly susceptible to sickness and death from COVID-19.

S stands for society and solutions. The pandemic has become the gravest existential problem of man and his society. It requires solutions—quick, safe, effective, sustainable. Solutions require money, something banks have in good measure. Banks must now reach out to a larger community or greater society. That means inclusion.

O means ownership. Bankers must deliver good yields to their owners so banks can continue to serve society. To do that, a banker must have enormous skill, unremitting integrity, and a passionate vision of a larger whole. Ownership also means commitment to every stakeholder in the business.

Pandemic’s challenges to banking

In a November 2020 interview with McKinsey, Ayala Corp. Chair Jaime Augusto Zobel de Ayala defined the challenges for business during the pandemic era. Those are also the challenges for the banking industry.

JAZA said: “Countries will have to use their balance sheets to pump-prime their economies and jumpstart economic activity. Different countries will have different levels of commitment to this. I’m more concerned about finding ways to stimulate the demand side of the economic equation, to ignite the willingness of individuals to start spending again, and to encourage a more optimistic view of the future. This will be more challenging than reopening the supply side, which involves allowing factories to start producing again and getting people back to work safely. We need to find ways to inspire confidence, believe in a future together, and begin to act in unison. That will require us to find new ways to cooperate, work in harmony across the public and private spheres nationally, and build on commonalities across regions.”

JAZA has sought to evolved the Ayala Group “to become more relevant to the needs of the country.” “We used to focus on the affluent end of the market in terms of our products and services,” he said. Now, he wants “to leave a legacy of an institution that addresses the needs of the vast majority of Filipinos. It also made sense to grow the institution by broadening and diversifying our market base.” The Ayala chieftain calls it “servicing the larger community.”

In broadening its consumer base, Ayala has “fostered a culture of technological know-how and innovation to address societal needs.”

Bank from Home

Edwin Bautista, the president and CEO of Union Bank, has parlayed his acute awareness of consumer needs honed as a brand manager at Procter and Gamble and marketing director of American Express in Guam and the Philippines of many years to pioneer Union Bank into digital banking.

Where people work from home, Union Bank has “Bank from Home”—send money, deposit checks, pay bills and manage account –online.

The technology tack has delivered awesome results for Union Bank. In 2020, its return on equity was 11.5%, down from 15.3% in 2019, but up from pre-pandemic’s 8.8% in 2018 and not far from the 11.9% in 2017. The 2020 return on assets of 1.5% is down from 1.9% in 2019 but substantially better than the 1.1% in 2018 and up from 1.4% in 2017. The bank has remained hugely profitable despite the pandemic difficulties. As a result, capital adequacy ratio—a measure of bank’s strength and capacity to absorb shocks—went up to 17% from 15.3% in 2019.

Part of Union Bank’s secret of profitability is a rigorous reduction in cost to income ratio—from 65.6% in 2018 to 55.4% in 2019 and to 50.8% last year, as interest cost went down and technology yielded efficiencies.

BDO and technology

Technology, says BDO Unibank President and CEO Nestor Tan, “is more an enabler, a tool, rather a threat or a disruptor, thus helping the banks make their services more seamless.”

The country’s largest bank has vigorously met the demand of consumers to do transactions anytime and anywhere. Thus, BDO customers have an option to withdraw, pay bills, transfer funds, and even invest—thru online or mobile banking. The trick in going digital and thrive in the business is not to focus on technology itself but on maintaining a strong relationship with customers. That BDO is doing. Digitalization has enabled the Henry Sy bank to pursue inclusive banking.

BDO has CORE values to deliver customer service and inclusion:

• C for “Customer focus”: “Everything we do must have the customer’s objective in mind.”

• O for “Out-of-the-box” thinking: “We are not constrained by traditional ways of doing things.”

• R for “Right attitude”: “We go the extra mile knowing that our job is not done until the client is satisfied.”

• E for “Excellent execution”: “From beginning to end, the whole servicing process must work without a problem.”

Metrobank’s meaningful banking

In 2019, Metrobank rebranded itself to deliver “meaningful banking” to “keep our promise of keeping customers ‘in good hands’, we must evolve as well,” said Metrobank President Fabian Dee. “Even if we are not able to serve them perfectly now, we commit to continuously improve so we can deliver meaningful banking every step of the way,” Dee explained.

Metrobank’s late founder George Ty defined the essence of banking. “It is not just about reaching the pinnacle of success; it is also about helping other people achieve their dreams.”

RCBC does well

For its part, Rizal Commercial Banking Corp. expanded its loan portfolio 7% to P4871.7 billion in first quarter 2021 in a bid to help small and medium enterprises during the pandemic. Loans to SMEs rose 10% while loans to corporates were up 8%.

In 2020, loans grew 9.6% or P42 billion to P449.2 billion, largely because of interbank lending. Corporate loans were up 4.2% or P9.6 billion and SME loans up 7.8% or P5.7 billion.

RCBC kept a tight watch on expenses, which grew just 2%.

Founded in 1963, RCBC is owned 52.68% by the YGC Group chaired by Helen Y. Dee and is the flagship company of the late Al Yuchengco’s sprawling conglomerate. With P772 billion in assets, RCBC is the sixth largest among local commercial banks. It has spent combined P1 billion in the past three years for IT to scale up its digitalization, an average of 1% of total revenues. In 2020 alone, the bank IT budget was 1.56% of revenues, triple previous years.

“COVID-19 delivered multiple shocks to the Philippine economy—a health crisis, strict quarantine measures, and a global recession of unprecedented scale,” reported RCBC President Eugene S. Acevedo to RCBC stockholders on 2020 results. “Household consumption dropped -7.9%, its worst performance on record, after being a major growth driver in the demand side of the economy in the past years. The decline was mainly due to a combination of factors that crippled domestic demand including record-high unemployment, declining household incomes, movement restrictions that reduced consumption, and a historic decline in consumer confidence,” he said.

The four Rs of strategy

The pandemic presented unprecedented challenges to the banks. They must now employ the four Rs of recovery strategy—React, Rethink, Resilience, and Realize. To their credit, the banks have proved equal to the challenge.

In 2020, RCBC demand deposits grew a hefty 52% or P36.64 billion to P107.17 billion. The bank reduced borrowings and retired debts. Bills payables went down dramatically, by 87% or P88.43 billion from P101.6 billion to just P13.16 billion. The bank prepaid a syndicated foreign borrowing of $300 million or P14.917 billion as part of liquidity management.

By the end of 2020, RCBC had kept its profits intact—P5.02 billion, down just 5% from P5.3 billion in 2019 but up 16.1% over 2018’s P4.32 billion. Consequently, the bank improved its capital adequacy ratio to 16.14%, from 13.74% in 2019, 16.13% in 2018 and 15.46% in 2017.

RCBC CEO

RCBC President Acevedo, 56, is a magna cum laude in Physics from the University of San Carlos in 1984 and has an MBA from AIM. RCBC got him from Union Bank to aggressively pursue RCBC’s digitalization and financial technology.

Another new recruit as a digital expert is Angelito M. Villanueva, 48, as RCBC EVP for Innovation and Inclusion. Lito has a masters degree in National Security Administration at the National Defense College and an MPA, magna cum laude, from UST in 2000.

For 2021 recovery, the mantra of RCBC is be a Challenger Bank. “The bank will grow its deposits, mostly CASA, through cash management services and increasing the customer base. Asset quality will be managed through a tight and strict monitoring of accounts and improvement in credit and remedial systems and loan growth will be moderate and in selective segments,” Acevedo said.

Acevedo added: “The Challenger Bank strategy is anchored on customer acquisition; improve processes to deliver fast and efficient service and give the best customer experience; and become the best digital alternative with a fully loaded mobile app.”

Pandemic-induced digital banking

If the pandemic has done any good to banking, it is to prompt more Filipinos to go online and embrace digitalization, says Wick Veloso, president of PNB and of the Bankers Association of the Philippines.

People normally don’t source their funds from banks. With the pandemic, the ratio of people sourcing funds from banks increased by half to 3% in 2020 from 2% of Filipinos who borrowed money in 2019.

Low banking penetration

PNB CEO Veloso rues that “the Philippines remains to be one of the nations with the lowest banking penetration rates in the world.”

In 2019, the number of unbanked Filipino adults was estimated at 51.2 million, almost half of the 110 million total population. A third of the country’s 1,500 towns do not have a bank branch. Two-thirds of Filipinos lack access to a formal bank account.

Per BSP survey, Filipino borrowers still use informal sources of credit.

— 44% borrowed from the people they personally know. Family, friends, relatives;

— 10% borrowed from loan sharks;

— 7% borrowed from financing lending companies;

— 3% from cooperatives, and;

— 31% from microfinance NGOs.

“We have to make more and more Filipinos enjoy banking services and move them away from illegal lenders,” says Veloso. The solution: A national ID system.

The BAP member banks have teamed up to help in the national ID rollout. They are also working on a credit rating system.

“I’ve seen in Ho Chi Minh how this tandem of the national ID system technology and credit scoring work,” narrates Veloso, “You go to a 2-wheeler shop, the agent of the 2-wheeler shop is no longer from Honda, Yamaha, whatever. The person who approaches you is from the financial institution and says ‘Mr. Juan dela Cruz this is the newest bike or this is the more affordable bike. What do you fancy? What is your interest?’ And if he is able to establish that this is the bank that interests me primarily because I can use it for business then ask Mr. Juan dela Cruz ‘can you share with me your national ID. 1-2-3-4-5 then dial it 1-2-3-4-5’. Within five seconds, the agent will be able to go back and say ‘Mr. Juan dela Cruz this motorbike—you are eligible to take it home’.”

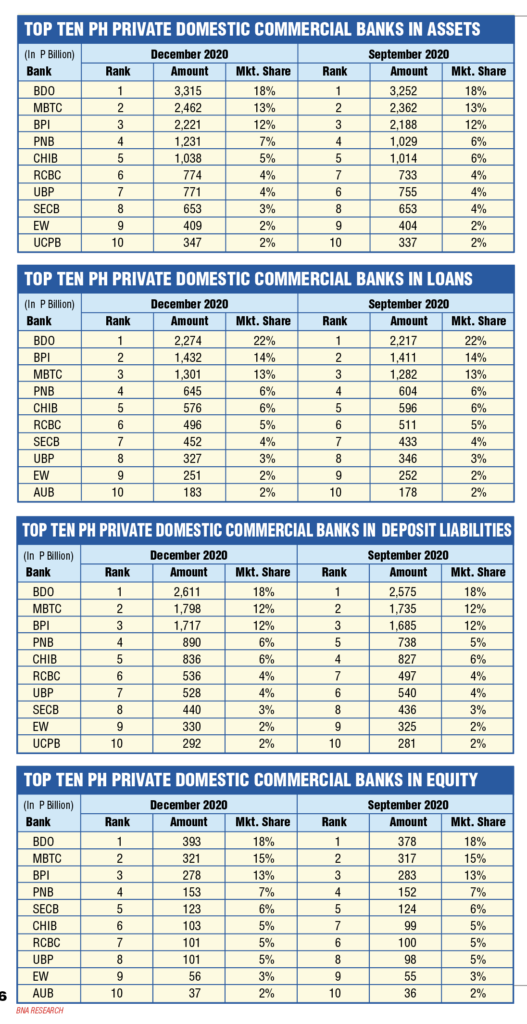

Banks grew bigger in 2020

During 2020, the banks’ resources grew steadily. Asset expansion was funded mainly by deposits, bond issuances and capital infusion.

“The growth of bank deposits specifically remained firm as consumers shifted to digital payments while funding cost and quoted bank lending rates declined following the decisive reduction in reserve requirements (RR) that started in November 2019,” said the Bangko Sentral reporting on the Philippine financial system for end-2020.

Moving forward, the BSP anticipates that the NPLs of the banking system will increase but these will remain within manageable levels.

The non-performing asset (NPA) ratio of the banking system was posted at 2.6% as of end-December 2020, higher than the 1.8% ratio as of end-December 2019. The NPA coverage ratio remained strong at 78.4%, wider than the 70.3% ratio as of end-December 2019.

FIST Act

The existing regulatory reliefs serve as an interim measure pending the full operationalization of the Financial Institutions Strategic Transfer (FIST) Act in 2021. The FIST Act is expected to assist the financial system perform its role of efficiently mobilizing savings and investments for the country’s economic recovery and sustained growth and development. It facilitates the transfer of the banking system’s non-performing assets to FIST corporations/Special Purpose Vehicles/eligible individuals by providing certain tax exemptions and fee privileges on said sale/transfer of NPAs.

Importantly, the BSP looks forward to the implementation of the FIST Act, which reinforces the BSFIs’ primary role of providing financial services and liquidity to support households, business enterprises and productive sectors of the economy by allowing BSFIs to dispose of their NPAs to FIST Corporations (FISTCs), Special Purpose Vehicles (SPVs) or to qualified individuals, and thus increase their risk- bearing capacity.

Resilience tested

BSP said “the COVID-19 pandemic tested the resilience of the banking system and the robustness of the financial ecosystem as the country reacts to the global health crisis. This novel crisis significantly affected the banking operations as the community quarantine and social distancing measures prompted banks to adjust their daily banking services.”

The BSP deployed targeted and time-bound regulatory relief packages that facilitated the uninterrupted flow of financial services in the country especially during this challenging time of the pandemic. It infused P2 trillion into the financial system so the economy could cope with the pandemic.

“The relief packages strived to address the critical requirements of the economy while at the same time ensuring that financial stability is not compromised”, BSP Governor Benjamin Diokno said.

The BSP’s financial soundness indicators (FSIs), which assessed the banking system’s strengths and weaknesses, affirmed that “the banking system is resilient during the pandemic year 2020 but implied that consequent risks from lending should be monitored, including emerging risks from demand side and supply side factors, which may amplify impact on the economy.”

Loan prices

BSP said its monetary policy transmission was effective in bringing down loan prices amid the pandemic.

The BSP’s monetary policy easing through reduction in key policy rates is being passed on by banks to consumers and business enterprises through lower and declining loan rates. This contributed to sustaining growth in the credit portfolio of the banking systems while coping with the new risks linked to the ensuing pandemic.

Fundamentally sound

The Philippine remained fundamentally sound and stable amid the COVID-19 pandemic. Assets, deposits, and capital all grew. Net profit remained positive.

The banks had more than stable capital buffers and ample loan loss reserves. The banking system, said BSP, “shifted to digital channels to keep its critical role in sustaining a functioning financial system with continued delivery of relevant financial services to the public during the pandemic.”

P19 trillion in assets

Total resources of the Philippine banking system rose to P19,449.4 billion (108.4% of GDP) as of end-December 2020 sourced from deposits, bond issuances and capital infusion.

The year-on-year (YoY) growth rate of 6.1%, however, was slower than the 8.4% growth rate recorded in December 2019 and the 11.5% in December 2018.

Commercial banks

Universal and commercial banks (U/KBs) made up the bulk of the banking system’s total assets at P18,045.5 billion (92.8% share). Total assets of thrift banks (TBs) and rural and cooperative banks (RCBs) registered at P1,129.3 billion (5.8% share) and P274.6 billion (1.4% share), respectively.

Loans held the largest share of the banking system’s total assets at 54% (P10,499.2 billion) followed by financial assets other than loans and cash and due from banks with 23.6% share (P4,592.2 billion) and 18.4% share (P3,581.7 billion), respectively. The composition of the banking system’s asset mix was relatively stable over the medium-term.

Credit growth slower

The banking system’s credit growth decelerated, as the economy slumped into a prolonged recession marked by an unprecedented 9.6% decline in GDP in 2020.

Still, the BSP deemed the deceleration “manageable considering the impact of the pandemic.”

Gross total loan portfolio (TLP) slightly slowed down YoY by 0.9% to P10,866.4 billion as of end-December 2020. Growth was 8.8% in December 2019. The lockdown limited corporate demand and economic activities.

“Unemployment, weak cash flows, temporary shutdown of businesses and economic uncertainty have dampened demand for loans and have even led creditors to tighten lending standards creating downside pull for credit growth,” explained the BSP.

Outlook this year

Per BSP survey of the banks, real GDP growth would return to a range of less than 6% to 6.3%. “The hardest hit sectors will recover in the next six months to two years,” BSP said. Meanwhile, majority of senior loan officers of banks survey reported keeping their overall credit standards for loans to both enterprises and households.

By economic activity, real estate activities comprised the largest share of the banking system’s TLP (total loan portfolio) at 18.8%. This was followed by wholesale and retail trade sector and loans for household consumption, which had TLP shares of 11.2% each. Electricity, gas, steam and air-conditioning supply and manufacturing sectors had TLP shares of 9.7% and 9.4%, respectively.

Real estate and consumer loans

Further growth in real estate lending is expected in line with the BSP’s easing of real estate loan (REL) limit of U/KBs from 20% to 25% of the total loan portfolio, net of interbank loans, over the medium term.

The banking system’s real estate exposures (REEs) and consumer loans (CLs) continued to grow, albeit at a decelerated pace. In particular, REEs of U/KBs and TBs, on a consolidated basis, increased by 5.5% YoY to P2,624 billion as of end-December 2020, significantly lower than the end-December 2019 growth rate of 14.1%.

Resident non-financial private corporations took almost half of borrowers in the banking system with loans amounting to P5,245.6 billion or a share of 48.3%.

China Bank ups profits 61%

China Banking Corp. (PSE stock symbol: CHIB) sustained its profitability in the first quarter 2021.

Profits increased 61% to P3.6 billion. This translated to an improved return on equity of 13.4% and return on assets of 1.4%.

“We are gratified by these very positive results and by the continued support of our customers and the dedication of our employees,” said China Bank President William C. Whang.

Amid the pandemic-induced economic downturn, China Bank continued to post strong growth in its core businesses, to provide higher pandemic-related buffers, to absorb the one-time impact of the CREATE law on deferred tax assets, and to keep the growth of operating expenses moderate despite adjusting priorities for pandemic-related expenses.

READ FULL ARTICLE HERE: